JULY • VOL. 7 • SERIES OF 2019

INSIGHTS is a monthly publication of BDB LAW to inform, update and provide perspectives to our clients and readers on significant tax-related court decisions and regulatory issuances (includes BIR, SEC, BSP and various government agencies).

DISCLAIMER: The contents of this Insights are summaries of selected issuances from various government agencies, Court decisions and articles written by our experts. They are intended for guidance only and as such should not be regarded as a substitute for professional advice.

Copyright © 2019 by Du-Baladad and Associates (BDB Law). All rights reserved. No part of this issue covered by this copyright may be produced and/or used in any form or by any means – graphic, electronic and mechanical without the written permission of the publisher.

What's Inside ...

- UPDATES

- Court Issuances

- CTA

- Regulatory Issuances

- BIR Issuances

- SEC Issuances

- IC Issuances

- IC Opinions

- BSP Issuances

- Court Issuances

- INSIGHTS

- A Decade of BDB Law

- HIGHLIGHTS

- Celebrating 10 Wonderful Years of BDB Law

- OUR EXPERTS

- The Personalities

- The CTA can rule on the validity of the revenue regulation or revenue memorandum circular on which the said assessment is based. (San Miguel Brewery Inc. v. Commissioner of Internal Revenue, CTA Case No. 9513, June 13, 2019)

- The prima facie evidence of false or fraudulent return will not apply if taxpayer did not substantially overstate its deductions. (Commissioner of Internal Revenue v. Banff Realty Development Corp., CTA EB Case No. 1710 (CTA Case No. 8803), June 10, 2019)

- In sales of other services subject to 0% VAT, it must be established that the recipient is a non-resident foreign corporation doing business outside the Philippines. (Deutsche Knowledge Services, Pte. Ltd. v. Commissioner of Internal Revenue CTA EB Case No. 1763 (CTA Case Nos. 8623, 8656, 8661 & 8685), June 7, 2019)

- Where the disputing parties are all public entities, the dispute shall be administratively settled or adjudicated by the Secretary of Justice, the Solicitor General, or the Government Corporate Counsel, depending on the issues and government agencies involved. (Commissioner of Internal Revenue v. Duty Free Philippines Corporation, CTA EB Case No. 1833 (CTA Case No. 9136), June 13, 2019)

- The disallowed/denied claim for input tax may be recovered and deducted as loss. (Commissioner of Internal Revenue v. Maersk Global Service Centres (Philippines) Ltd. CTA EB Case No. 1786 (CTA Case No. 8934), June 13, 2019)

- The law created a presumption of ownership of imported articles, which is vested with the consignee. (Moises Bagan Rodriguez v. People of the Philippines, CTA EB Crim No. 043 (CTA Crim Case No. O-282), June 18, 2019)

- In claims for tax refund, the CTA as a court of record is required to conduct a formal trial (trial de novo) to prove every minute aspect of the claim. (Philippine Associated Smelting and Refining Corporation v. Commissioner of Internal Revenue, CTA Case Nos. 9579 & 9580, June 24, 2019)

- Only the Regional Directors, Deputy Commissioners and the Commissioner of Internal Revenue have the authority to sign LOAs. A waiver with no indication of date of acceptance is void. (Amparo Shipping Corporation v. Commissioner of Internal Revenue, CTA Case No. 9387, June 28, 2019)

The CTA can rule on the validity of the revenue regulation or revenue memorandum circular on which the said assessment is based

This case involves a claim for refund of erroneous, excessive or illegal payments of excise taxes based on RMC No. 90-2012 and RR No. 17-2012. Taxpayer assailed the validity of RMC No. 90-2012 and RR No. 17-2012. The BIR opposed, arguing that the CTA has no jurisdiction since taxpayer is collaterally assailing the validity of revenue issuances. It argued that the validity or constitutionality of a revenue issuance cannot be collaterally attacked in claims for refund. A separate action must be filed solely for that purpose.

In upholding its jurisdiction over this case, the CTA ruled that it has the power of certiorari in cases within its appellate jurisdiction. Thus, the CTA can rule not only on the propriety of an assessment or tax treatment of a certain transaction, but also on the validity of the revenue regulation or revenue memorandum circular on which the said assessment is based. (San Miguel Brewery Inc. v. Commissioner of Internal Revenue, CTA Case No. 9513, June 13, 2019)

The prima facie evidence of false or fraudulent return will not apply if taxpayer did not substantially overstate its deductions.

The BIR invoked the 10-year period to assess. But the CTA ruled that the 10-year period to assess only applies if there is a filing of a false or fraudulent return with intent to evade tax or if there is a failure to file a tax return.

What is constitutive of a prima facie evidence of a false or fraudulent return is either a substantial under-declaration of sales, receipts or income, or a substantial overstatement of deductions. There is a substantial under-declaration of sales, receipts or income, when there is failure to report sales, receipts or income exceeding 30% of the one declared per return; and there is a substantial overstatement of deductions when it exceeds 30% of the actual deductions.

In this case, there is neither substantial under-declaration of sales, receipts or income nor a substantial overstatement of deductions, based on the 30% threshold established by law. Thus, the 10-year period to assess cannot apply. (Commissioner of Internal Revenue v. Banff Realty Development Corp., CTA EB Case No. 1710 (CTA Case No. 8803), June 10, 2019)

In sales of other services subject to 0% VAT, it must be established that the recipient is a non-resident foreign corporation doing business outside the Philippines.

To be considered as a non-resident foreign corporation doing business outside the Philippines, the following documents must be presented: (a) Certificate of Non-registration of Corporation/ Partnership issued by the Philippine Securities and Exchange Commission (SEC) to establish that the recipient of the service has no registered business in the Philippines and (b) a Certificate/Articles of Foreign Incorporation/Association to prove that the recipient is a indeed foreign entity.

The Intra Group Service Agreements presented by the taxpayer, showing the names of its customers to whom it rendered services, would not establish that the service recipients are non-resident foreign corporations doing business outside the Philippines. (Deutsche Knowledge Services, Pte. Ltd. v. Commissioner of Internal Revenue CTA EB Case No. 1763 (CTA Case Nos. 8623, 8656, 8661 & 8685), June 7, 2019)

Where the disputing parties are all public entities, the dispute shall be administratively settled or adjudicated by the Secretary of Justice, the Solicitor General, or the Government Corporate Counsel, depending on the issues and government agencies involved.

Where the disputing parties are all public entities, the dispute shall be administratively settled or adjudicated by the Secretary of Justice (SOJ), the Solicitor General, or the Government Corporate Counsel, depending on the issues and government agencies involved.

Cases involving questions of law between and among departments, bureaus, offices, agencies and instrumentalities of the National Government, including government-owned-and-controlled corporations (GOCCs), shall be submitted to and settled or adjudicated by the SOJ. On the other hand, cases involving mixed questions of law and of fact, or purely factual issues shall be submitted to the Solicitor General if the latter if the principal law officer or general counsel of the parties; otherwise, the issues shall be submitted to and resolved by the SOJ.

Based on the foregoing, the CTA denied the claim for refund of taxpayer, which is a public entity, of its VAT on importation of alcohol and tobacco merchandise, for lack of jurisdiction. (Commissioner of Internal Revenue v. Duty Free Philippines Corporation, CTA EB Case No. 1833 (CTA Case No. 9136), June 13, 2019)

The disallowed/denied claim for input tax may be recovered and deducted as loss.

In this case, the CTA allowed taxpayer to recover as loss the amount of its claim for refund of unutilized input VAT, which was denied for failure to comply with the invoicing requirements. The amount of claim was allowed as deduction from taxpayer’s gross income in the year of denial of claim (2010).

The CTA held that under RR No. 09-89, which provides the journal entries for the recording of transactions if there are disallowed/denied input taxes, the disallowed/denied claim for input tax is recorded as Purchases or Cost of Sales, which is classified as an expense account and a deduction from the taxpayer’s sales/revenue.

The CTA further held that the requisites for deductibility of such claim as a loss were all complied with. The taxpayer actually sustained a loss when its claim for refund was denied and the same can no longer be recovered. The loss was sustained in 2010 when the taxpayer received the denial letter. Taxpayer was not compensated for the loss. It also incurred the loss in the conduct of its trade or business as the denied input taxes arose from its zero-rated sales of services.

Finally, the loss arose from a closed and completed transaction in that it was specifically stated in the denial letter that taxpayer’s claim “cannot be given due course.” (Commissioner of Internal Revenue v. Maersk Global Service Centres (Philippines) Ltd. CTA EB Case No. 1786 (CTA Case No. 8934), June 13, 2019)

NOTE: In this case, the CTA applied the old RR No. 09-89 since there is no explicit rule as to the treatment of disallowed/denied application for refund or issuance of tax credit certificate on input VAT attributable to zero-rated sales under the Tax Code. This position runs counter that contained in RMC No. 57-2013, which circularizes BIR Ruling No. 123-2013 dated March 25, 2013, stating that unutilized creditable input taxes attributable to VAT zero-rated sales cannot be claimed as a deduction for income tax purposes.

The law created a presumption of ownership of imported articles, which is vested with the consignee.

The accused, a sole proprietor engaged in the business of dealing and importing surplus auto parts and merchandise, was charged of violation of the Tariff and Customs Code by fraudulently misdeclaring and misrepresenting the nature of the articles it imported when it declared the goods to be ‘pastries’ and ‘dough” when it were, in fact, onions. The prosecutor argued that based on the testimony of the witnesses and the pieces of documents submitted, he was able to convincingly establish the fact of illegal importation and the identity of the importer, who is the accused. The accused claimed that the prosecution failed to establish that he is the author of the illegal smuggling, and thus, should be acquitted.

The CTA found the accused guilty. It explained that the law created a presumption of ownership of imported articles, which is vested with the consignee. Whether or not the taxpayer participated in the preparation of the bill of lading is immaterial in this case to disprove ownership, due to the aforesaid presumption. It was imperative for the taxpayer to disprove ownership of the said articles by showing proof to the contrary. Since the accused was unable to do so, the shipments in this case are considered his property, and the misdeclaration as to the nature of the articles imported made him guilty of the offense charged. (Moises Bagan Rodriguez v. People of the Philippines, CTA EB Crim No. 043 (CTA Crim Case No. O-282), June 18, 2019)

In claims for tax refund, the CTA as a court of record is required to conduct a formal trial (trial de novo) to prove every minute aspect of the claim.

The CTA, in denying the taxpayer’s claim, reiterated that in claims for tax refund, it is required to conduct a formal trial to prove the claim. The claims are litigated and decided based on what has been presented and formally offered and presented during the trial. The CTA held that the exhibits presented by the taxpayer were denied since these were not identified and authenticated by a competent witness. Thus, the CTA cannot consider the documents as evidence since evidence which has not been admitted cannot be validly considered by the courts in arriving at their judgments. (Philippine Associated Smelting and Refining Corporation v. Commissioner of Internal Revenue, CTA Case Nos. 9579 & 9580, June 24, 2019)

Only the Regional Directors, Deputy Commissioners and the Commissioner of Internal Revenue have the authority to sign LOAs. A waiver with no indication of date of acceptance is void.

In this case, the CTA reiterated some common technical defects in the issuance of a Final Letter of Demand (FLD) and Final Assessment Notice (FAN).

According to the CTA, only the Regional Directors, Deputy Commissioners and the Commissioner of Internal Revenue have the authority to sign LOAs. Thus, a Letter of Authority (LOA) is void when it is signed by the OIC-Assistant Regional Director. The fact that the OIC subsequently became the Regional Director did not cure the defect. Since the LOA is void, the deficiency tax assessment is likewise void.

The CTA further added that the BIR’s right to assess the taxpayer’s liabilities had already prescribed since the FLD/FAN was issued beyond the three-year prescriptive period. This period was not validly extended since the waivers did not indicate the date of acceptance by the BIR. (Amparo Shipping Corporation v. Commissioner of Internal Revenue, CTA Case No. 9387, June 28, 2019)

- RR No. 7-2019, June 13, 2019 – This changed the definition of top withholding agents to refer to taxpayers whose gross sales/receipts or gross purchases or claimed deductible itemized expenses, as the case may be, amounting to Php 12,000,000.00 during the preceding taxable year.

- RR No. 8-2019, June 25, 2019 – It prescribes the form to be used in filing and payment of estate tax return and in proving the fact of withholding of tax on the deposits of the decedent.

- RMC No. 59-2019, June 7, 2019 - This prescribes the requirements in availing the incentives of cooperatives registered with the Cooperative Development Authority (CDA) as well the requirements in filing the Annual Incentives Report and the penalties for non-compliance.

- RMC No. 60-2019, June 7, 2019 – This reiterated that the transfer of real property by an Ecozone Developer/Operator registered under the Philippine Economic Zone Authority (PEZA) to another PEZA entity which are both enjoying the 5% preferential rate is exempt from DST. This also provided the documentary requirements for the processing of the Electronic Certificate Authorizing Registration (eCAR) for the same.

- RMC No. 64-2019, June 18, 2019 – This clarifies the nature of taxpayers’ liabilities which have to be verified in processing the Delinquency Verification Certificate in claims for VAT credit/refund.4.

Revenue Regulations No. 7-2019 (July 13, 2019)

There is now a different criteria to qualify as a top withholding agent. RR No. 7-2019 has amended RR No. 11-2018.

| Comparative Table on RR No. 7-2019 and RR No. 11-2018 | |

| OLD RULE Section 2.57.2 (I), RR No. 2-98, as amended further by RR No. 11-2018 |

NEW RULE Section 2.57.2 (I), RR No. 2-98, as amended further by RR No. 7-2019 |

|

Top withholding agents shall include the following: a. Classified and duly notified by the Commissioner as either any of the following unless previously de-classified as such or had already ceased business operations: (1) A large taxpayer under Revenue Regulations No. 1-98, as amended; b. Taxpayers identified and included as Medium Taxpayers, and those under the Taxpayer Account Management Program (TAMP). The top withholding agents by concerned LTS/RRs/RDOs shall be published in a newspaper of general circulation. It may also be posted in the BIR website. These shall serve as the “notice” to the top withholding agents. The obligation to withhold under this sub-section shall commence on the first (1st) day of the month following the month of publication. Existing withholding agents classified as large taxpayers, top 20,000 private corporations or top 5,000 individuals which have not been delisted prior to these regulations shall remain as top withholding agents. The initial and succeeding publications shall include the additional top withholding agents and those that are delisted. |

Top withholding agents shall refer to those taxpayers whose gross sales/receipts or gross purchases or claimed deductible itemized expenses, as the case may be, amounted to TWELVE MILLION PESOS (P12,000,000.00) during the preceding taxable year. The top withholding agents by concerned LTS/RRs/RDOs shall be published in a newspaper of general circulation. It may also be posted in the BIR website. These shall serve as the “notice” to the top withholding agents. The obligation to withhold under this sub-section shall commence on the first (1st) day of the month following the month of publication. Taxpayers who are classified as top withholding agents prior to the effectivity of these Regulations shall remain as such until failure to satisfy the aforesaid criteria and duly published as delisted from the existing list of top withholding agents. The initial and succeeding publications shall include the additional top withholding agents and those that are delisted. |

|

Note: RR No. 7-2019 explicitly provides that taxpayers previously classified as top withholding agents remain as such until they failed to satisfy the criteria that the said RR has set; and are duly delisted from the existing list of top withholding agents. RR No. 7-2019 does not dispense with the requirement of publication as notice to the top withholding agents before they may be considered as such. |

|

Revenue Regulations 8-2019 (June 25, 2019)

RR No. 8-2019 clarifies what BIR Forms to be used in paying the estate tax and in remitting the same to the BIR.

| Comparative Table on RR No. 8-2019 and RR No. 12-2018 | |

| RR No. 12-2018 | RR No. 8-2019 |

|

SEC. 9. TIME AND PLACE OF FILING ESTATE TAX RETURN AND PAYMENT OF ESTATE TAX DUE. – 1. Estate Tax Returns. – XXX 6.1. Cash installment |

SEC. 9. TIME AND PLACE OF FILING ESTATE TAX RETURN AND PAYMENT OF ESTATE TAX DUE. – 1. Estate Tax Returns. – XXX 6.1. Cash installment |

|

SEC. 10. PAYMENT OF TAX ANTECEDENT TO THE TRANSFER OF SHARES, BONDS OR RIGHTS AND BANK DEPOSITS WITHDRAWAL. – XXX……XXX If a bank has knowledge of the death of a person, who maintained a bank deposit account alone, or jointly with another, it shall allow the withdrawal from the said deposit account, subject to a final withholding tax of six percent (6%) of the amount to be withdrawn, provided that the withdrawal shall only be made within one year from the date of the decedent. The bank is required to file the prescribed quarterly return on the final tax withheld on or before the last day of the month following the close of the quarter during which the withholding was made. The bank shall issue the corresponding BIR Form No 2306 certifying such withholding. In all cases, the final tax withheld shall not be refunded, or credited on the tax due on the net taxable estate of the decedent. |

SEC. 10. PAYMENT OF TAX ANTECEDENT TO THE TRANSFER OF SHARES, BONDS OR RIGHTS AND BANK DEPOSITS WITHDRAWAL. – XXX……XXX If a bank has knowledge of the death of a person, who maintained a bank deposit account alone, or jointly with another, it shall allow the withdrawal from the said deposit account, subject to a final withholding tax of six percent (6%) of the amount to be withdrawn, provided that the withdrawal shall only be made within one year from the date of death of the decedent. The bank shall remit to the BIR the withholding tax prescribed under this Section by filing a duly accomplished Monthly Remittance Form of Taxes Withheld on the Amount Withdrawn from the Decedent’s Deposit Account (BIR Form No. 0620) [See Annex “A”] and remit the tax withheld on or before the tenth (10th) day following the month when the withholding was made. However, if the tax was withheld on the third month of the quarter, instead of using BIR Form No. 0620 in the remittance of tax withheld, a quarterly remittance return (BIR Form No. 1621) [See Annex “B”] shall be filed and the corresponding final withholding tax paid on or before the last day of the month following the close of the quarter during which the withholding was made. The bank shall issue the corresponding BIR Form No. 2306 certifying such withholding, with the original and duplicate copies issued to the executor, administrator or any of the legal heirs of the decedent while the third copy retained by the bank as its reference file. The duplicate copy shall be submitted by the executor, administrator or the authorized legal heir to the RDO having jurisdiction over the place where the decedent was domiciled at the time of his or her death, within five (5) days from its receipt. In all cases, the final tax withheld shall not be refunded, however, may be credited from the tax due in instances where the bank deposit account subjected to final withholding tax has been actually included in the gross estate declared in the estate tax return of the decedent. |

RMC No. 59-2019, June 7, 2019

This publishes the full text of Joint Administrative Order No. 1-2019 entitled "Rules and Regulations Implementing Section 3 of Republic Act (RA) No. 10963, Otherwise Known as the Tax Reform Acceleration and Inclusion Law, In Relation to Section 5(b) of RA No. 8424 of the National Internal Revenue Code, as amended”

Under the circular:

1. For purposes of availing income-tax based incentives, only electronically filed tax returns shall be considered except when manual filing is allowed in accordance with BIR revenue issuances.

2. Notwithstanding the manual filing, the registered cooperatives are still required to file electronically within thirty days (30) days reckoned from the time the electronic filing/payment system is operational/available.

3. All registered cooperatives which were issued a Certificate of Tax Exemption (CTE) and availed of tax incentives shall submit to the CDA the Annual Tax Incentives Report. The Annual Tax Incentives Report shall be submitted within 15 days from the due date of filing the Annual Income Tax Return.

4. Submission of the reportorial requirements shall be a continuing requirement for the effectivity of the CTE of a registered cooperative. Failure to comply the same shall be a ground for revocation of CTE and it shall also be a cause for prohibition of availment of tax exemption for the following given periods, depending on the number of violations:

a. First Offense – prohibited to avail of tax exemption for a period of one (1) year from date of revocation;

b. Second Offense – prohibited to avail of tax exemption for a period of three (3) years from date of revocation;

c. Third Offense – prohibited to avail of tax exemption for a period of five (5) years from date of revocation; and

d. Fourth Offense – prohibited from re-application.

RMC No. 60-2019, June 7, 2019

This clarified that RA No. 7916, as amended, provides that PEZA-registered enterprises whose registered activities are subject to the 5% final tax on Gross Income Earned (GIE) are exempt from all national and local taxes. Hence, a sale of a real property located within an ecozone by a PEZA-registered Ecozone Developer/Operator to another PEZA-registered enterprise, is not subject to DST, provided that both entities are subject to the 5% preferential rate and such sale or disposition is directly pursuant to their registered activities.

With respect to the issuance of the eCAR, the following documents are required to support the tax exemption:

1. Certified true copy of the latest PEZA Certificate of Registration of the parties to the transaction;

2. Certified true copy of PEZA Registration Agreement; and

3. Certified true copies of the following PEZA certificates as of the time of the transaction:

a) PEZA Form No. 00-00-01 (Certification on Entitlement of 5% Gross Income Tax); and

b) PEZA Form No. 00-03-01 (Certification on Available Incentives).

RMC No. 64-2019, June 18, 2019

This clarified the policy regarding the issuance of Delinquency Verification Certificate for claims for VAT credit/refund, pursuant to Section 112 of the Tax Code. It emphasized that under RMC No. 47-2019, those taxpayers who shall have no outstanding liabilities (Accounts Receivable/Delinquent Account or AR/DA) as defined under Sec. II (1) of RMO No. 11-2014 are those which do not have the following liabilities:

1. Self-assessed tax liability:

a. Dishonored checks;

b. Tax due per return filed by taxpayer who failed to pay the same within the time prescribed for payment; or

c. Non-payment of the 2nd instalment due from individual taxpayers who availed of the instalment payments of income tax under the Tax Code.

2. Those arising from deficiency assessment which became final and executory due to:

a. Failure to file a request for reinvestigation/reconsideration within 30 days from receipt of the FAN;

b. Failure to submit documents in support of the request for reinvestigation within 60 days from filing of the request;

c. Failure to appeal to the Court of Tax Appeals (CTA) within 30 days from receipt of the decision of the BIR or in case of inaction;

d. Failure to appeal the CTA’s decision; or

e. Final and executory decision/resolution by the CTA/Supreme Court in favor of the BIR.

“Open stop-filer cases” and deficiency tax assessments which are timely protested, subject to reconsideration/reinvestigation, or pending judicial appeal are not considered as AR/DA, and shall not prevent the processing of VAT refund.

The circular likewise indicated that under RMC No. 47-2019, only the following offices shall issue delinquency verification certificates to the claimants of credit/refund:

1. The Collection Division of the respective Regional Office and Accounts Receivable Monitoring Division (ARMD) for non-large taxpayers;

2. The Large Taxpayers Collection Enforcement Division (LTCED) and ARMD for taxpayers under the jurisdiction of the LT Service of the National Office; or

3. The LT division-Cebu/LT Division-Davao and their respective ARMD for large taxpayers under the jurisdiction of LT Division-Cebu or Davao.

Finally, RMC No. 64-2019 ordered that the concerned offices should not issue any format that deviates from the format prescribed under the same RMC. If there is no outstanding tax liability, or if the assessed tax liability is under protest/appeal or if there are “open stop-filer cases,” the box that should be checked is that which indicates “HAS NO DELINQUENT TAX LIABILITY”. Thus, there is no need to state the details of the said cases in the DVC.

- SEC-OGC Opinion No. 19-23, June 17, 2019 – In this opinion, the SEC ruled that prior approval from the SEC is not required before a corporation may validly issue cash and stock dividends.

- SEC-OGC Opinion No. 19-24, June 24, 2019 – An illustration was provided in this opinion in determining the nationality of a corporation.

- SEC Memorandum Circular No. 13, Series of 2019, June 21, 2019 – This amended the guidelines and procedures on the use of corporate and partnership names.

SEC-OGC Opinion No. 19-23, June 17, 2019

This opinion was issued at the request of Toyota Manila Bay Corporation, an unlisted corporation, to confirm whether or not written approval/advice of the SEC is required before it may validly issue cash and stock dividends to its stockholders.

The SEC responded in the negative. It ruled that Sec. 42 (1) of the Revised Corporation Code did not require prior approval/advice from the SEC in order to declare cash and stock dividends. For the declaration of cash dividends, the only requirements are (1) the approval of the Board of Directors and (2) sufficient unrestricted retained earnings for the last fiscal or calendar year. The same requirements are imposed for the declaration of stock dividends plus the stockholders’ approval representing at least 2/3 of the outstanding capital and sufficient portion of the present authorized capital.

However, a corporation still has the option to apply for an acknowledgement notice from the SEC of its declaration of cash and/or stock dividends, if it wishes to do so, subject to submission of documentary requirements and payment of filing fee.

SEC-OGC Opinion No. 19-24, June 24, 2019

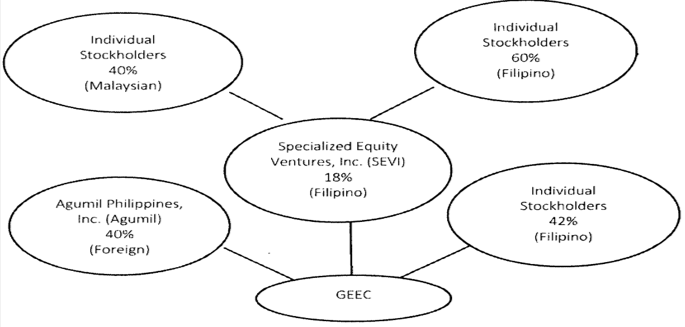

This opinion was issued at the request of Green Earth Enersource Corporation (GEEC) to secure an opinion on whether or not it has complied with the nationality requirement under the 1987 Constitution and Renewable Energy Act of 2008.

Following the tests of nationality (control test and grandfather rule), GEEC met the nationality requirement based on the following corporate structure:

The 18% equity of SEVI and 42% equity of the individual Filipino shareholdings is sufficient to satisfy the 60%-40% ownership nationality requirement.

SEC Memorandum Circular No. 13, Series of 2019, June 21, 2019

This amended the guidelines and procedures on the use of corporate and partnership names.

The substantial changes from the previous guidelines and procedures are as follows:

1. The name of a One Person Corporation shall contain the word “OPC” either below or at the end of the name;

2. A single stockholder of a One Person Corporation (OPC) may use his/her name; provided that said name shall be accompanied with descriptive words aside from the suffix OPC. A single stockholder may also use the name of another person, provided that consent was given by the said person or if deceased, by his estate, and provided further that the name shall be accompanied by the descriptive words other than the suffix OPC;

3. The name shall be distinguishable (previously should not be identical, misleading, or confusingly similar) from other corporate or partnership name registered with the SEC, or with the Department of Trade and Industry, in the case of sole proprietorships;

4. The registration of name bearing the word ASEAN shall be in accordance with the protection given by Article 6ter of the Paris Convention of Industrial Property, adopted in 1883 and revised in Stockholm in 1967;

5. The name of a corporation or partnership that has been dissolved or whose registration has been revoked shall not be used by another corporation or partnership within five (5) years from the approval of dissolution or date of revocation, unless its use has been allowed at the time of dissolution or revocation by the stockholders, members, or partners who represented a majority of the outstanding capital stock or membership of the dissolved corporation or partnership, as the case may be;

6. In order that the name of a corporation whose registration has expired may be used, the application for re-registration must be accompanied by the following documents:

1. Board Resolution executed and signed by the hold-over board of directors/trustees attesting that:

a. The applicant for re-registration is a new corporation intending to use the name of the expired corporation;

b. The re-registration is approved by the majority vote of the directors or trustees and the vote of stockholders representing the majority of the outstanding capital stock or membership;

c. They shall include a statement in the articles of incorporation of the new corporation that the same is using the name of the expired corporation; and

d. If applicable, they will no longer file a petition to set aside the order of revocation.

2. Latest General Information Sheet of the expired corporation, received by the SEC;

3. Affidavit, executed under oath by the hold-over corporate secretary , attesting that:

a. There are no properties owned by the dissolved/revoked corporation due for liquidation, or in case there are properties owned by the expired corporation, no property is transferred to the new corporation or, in case of stock corporations, used for subscription payment without undergoing corporate liquidation process;

b. There is no pending intra-corporate dispute or claim involving the expired corporation; and

c. That the expired corporation has no derogatory information with the SEC at the time of its application for re-registration.

Upon approval of the re-registration, the certificate of registration to be issued to the new corporation shall indicate its new SEC registration number and pre-generated Tax Identification Number (TIN) as confirmation that the same is a separate and distinct entity from the expired corporation.

7. A corporate or partnership name, which was previously used but become the subject of amendment, shall not be re-registered or used by another corporation or partnership for a period of three (3) years from the date of the approval of the adoption of the new corporate or partnership name. However, an earlier period may be allowed if the corporation or partnership which previously owned the used name give its consent as proven by the following:

For Corporations:

a. Directors/Trustees’ Certificate approved by the majority of the Directors/Trustees approving the use of the former name by another corporation or partnership; and

b. Secretary’s Certificate of non-existence of intra-corporate dispute from the Corporation that used the former corporate name.

For Partnerships:

a. Partnership’s Resolution approved by the majority of the partners approving the use of the former name by another corporation or partnership.

For One Person Corporations:

a. The consent of the sole stockholder or, in cases of incapacity or death, his/her designated nominee, given in notarized instrument and countersigned by the Corporate Secretary.

8. Names of absorbed/constituent corporation may not be used unless it is the surviving corporation intending to use the said absorbed/constituent corporate name. Provided, however, that another corporation may use the names of the absorbed/constituent corporation if the consent of the surviving corporation is obtained, as proven by the following:

a. Directors’ Certificate of the surviving corporation permitting the usage of the said absorbed/constituent corporation by another corporation; and

b. Secretary’s Certificate of non-existence of intra-corporate dispute of the corporation from the surviving corporation.

- IC-CL No. 2019-23, June 17, 2019 – This mandates endorsement from Adjusters Association of Philippine Adjustment Companies (APAC) or the Philippine Institute of Loss Adjusters (PILA) for application for license of new insurance adjusters.

- IC-CL No. 2019-31 June 25, 2019 – This provides for the regulation and prohibitions relating to the conduct of business of agents of health maintenance organization (HMO).

IC-CL No. 2019-23, June 17, 2019

This requires that all applications for license of new insurance adjusters must first be endorsed by either the Association of Philippine Adjustment Companies (APAC) (for adjusting companies) or the Philippine Institute of Loss Adjusters (PILA) (for individual adjusters). Endorsement from APAC or PILA must be attached together with the application for license of insurance adjusters and be submitted to the Licensing Division.

Failure to secure endorsement and non-submission of other requirements will result to non-acceptance of application

Membership, non-payment of association dues and other fees to APAC or PILA shall not hinder the approval of endorsement from the two associations.

Should the endorsement be not forthcoming, the applicant shall be duly notified for the reasons thereof. Should the applicant find the reason/s to be uniustified, the matter shall be elevated to the lnsurance Commission, who may direct the issuance of the license even without the endorsement if he finds that the non-endorsement is unjustified.

IC-CL No. 2019-31, June 25, 2019

Any person who, for compensation, solicits or obtains a contract or agreement on behalf of any health maintenance organization (HMO) or transmits for a person other than himself an application for a contract or agreement to or from an HMO or offers or assumes to act in the negotiating of such contract or agreement shall be an HMO agent.

The following conduct and activities of HMO agents are prohibited:

1. Conducting fraudulent or dishonest practices;

2. Misappropriating or converting to their own use or illegally withholding money required to be held in a fiduciary capacity;

3. Materially misrepresenting the terms and conditions of contracts or agreements which he seeks to sell or has sold;

4. Engaging in unsafe business acts or practices;

5. Engaging in any form of unacceptable behavior by agent; and

6. Other analogous circumstances.

In addition, agents of HMO are likewise enjoined to observe proper conduct and behavior in the performance of their business.

lf, after proper notice and hearing, the Insurance Commission determines that the person charged has engaged in any of the prohibited conduct and activities, the Commission shall issue an order requiring such person to cease and desist from engaging in such conduct or activity and shall, impose the following fines, depending on the number of violations:

a. First offense – P5,000.00;

b. Second offense – P10,000.00;

c. Third offense – P15,000.00; and

d. Fourth and other succeeding offenses – blacklisting.

- IC-LO No. 2019-08-A, June 19, 2019 - The tractor head and the trailer are treated as separate vehicles for insurance purposes, and thus, they should be covered by separate comprehensive insurance.

IC-LO No. 2019-08-A, June 19, 2019

As a rule, the tractor head and the trailer are treated as separate vehicles for insurance purposes. Hence, they should be covered by separate comprehensive insurance.

However, with regard to Liability to the Public, No Fault lndemnity and Excess Liability Provisions under a standard Comprehensive lnsurance, having a separate comprehensive insurance for the tractor head and the trailer is not material, for any injury or death to any third party by reason which is directly attributable to driver. While the trailer is attached to and is being towed by the tractor head, it is the tractor head's driver who has direct control of the movement of both the tractor head and the trailer attached to it. As such, the Comprehensive lnsurance of the tractor head shall be held liable for third party liability arising from death, bodily injury or third party property damage.

The separate insurance coverage matters in case the proximate cause of the injury or death is directly attributable to the trailer, e.g., when the injury or death is specifically attributable to the defects of the trailer's equipment such as its wheel/s, bearing/s, lock/s, etc. ln this case, the insurance policy of the trailer, if any, should be held liable for death or bodily injury to third party. The comprehensive insurance of the tractor is not answerable in this instance. A separate Comprehensive lnsurance for the tractor head and the trailer becomes also material when it comes to loss or damage to the insured vehicle.

- BSP-CL No. CL-2019, June 27, 2019 – This circularizes the new Bangko Sentral Registration Document (BSRD) template in registering foreign investments to be used effective July 1, 2019.

BSP-CL No. CL-2019, June 27, 2019

Effective July 1, 2019, a new Bangko Sentral Registration Document (BSRD) template in registering investments falling under Section 37 of the Manual of Regulations on Foreign Exchange Transactions, as amended, shall now be used.

Copy of which may be downloaded from the BSP website at http://www.bsp.gov.ph/downloads/Retulations/MORFXf/MORFXT-faas.zip.

A Decade of BDB Law

By Irwin C. Nidea, Jr.

I joined BDB Law, a few months after its inception. It seems like yesterday when a firm of one lawyer, one secretary and one liaison officer, grew to around forty (40) personnel in the last ten (10) years – a boutique firm specializing in tax and corporate law.

To show its gratitude to clients and friends, and as part of the celebration of its 10th anniversary, BDB Law sponsored a Mid-Year Tax Forum that tackled three (3) important topics:

1. Boarding the Tax Train: After the first stage of TRAIN Law implementation, there is now sufficient period to assess its effect and the challenges in making it work. The speakers from the Bureau of Internal Revenue (BIR) and the Department of Finance (DOF) asserted that the TRAIN is working. There was an increase in tax collection which helped realize the infrastructure programs of the government. As regards the general tax amnesty, it seems that the DOF will not initiate the refiling of the same in Congress. If we want the general tax amnesty to pass, our Congressmen must be willing to include a provision of waiver of the bank secrecy law. The BIR is also firm in its stand that the definition of “delinquencies” is limited to assessments that have become final and executory. Thus, “delinquencies” arising from non-payment of the tax liability declared in the tax returns, are not covered by the tax amnesty law.

2. Taxing the Digital: This panel discussion was very interesting since the speakers are experts from Singapore and Malaysia who have wide experience in the realm of digital economy. The panel discussion revolved around the rise of Fin-Techs and the much urgent need to plug the Digital Leaks. There is also an increase use of e-commerce, cryptocurrencies and blockchain technology. They present tax compliance challenges for both the businesses and governments.

Because of digital technology, the definition of ‘Permanent Establishment” is evolving. With the rise of e-commerce and the digital economy, determining the source of the income is more vague. Income has no intrinsic geographical location attached to it. The assets and activities involved in generating the income can be located in more than one State, thus rendering the source unclear – A single firm’s activities can potentially stretch across multiple boundaries – E.g. business profits derived from the manufacture of goods in State A, the sale of the goods through an online platform based in State B, and the delivery of the goods to the consumer in State C. Thus, Source Taxation is becoming more challenging as a meaningful starting point for international taxation allocation.

There was also a discussion on transfer pricing. It is a rich revenue source that the BIR continuously disregard. There are Philippine conglomerates and multinational corporations which do not buy and sell to each other, at arm’s length. Tax leakages are rampant because the BIR may not have the capability and facility to implement transfer pricing rules. It was eye opening to learn in 2011, Starbucks had a £398Million revenue but paid zero (0) tax in the UK? Google on the other hand, had a £2.6 Billion revenue in 2011 in the UK, but only paid £6 Million in tax.

3. The last panel discussion is entitled: Tilting the Balance towards Transparent, Sustainable and Inclusive Taxation. Enforcement of greater transparency in reporting and ensuring that the tax revenues will go towards improving the quality of life of the citizens are issues that are driving tax policies. Companies need to brace themselves for these developments and start re-assessing business and tax strategies in the light of the future demand for public disclosures of tax information.

After an afternoon of intense discussions, BDB Law celebrated with clients and friends in a night of cocktail and broadway. A new book of the Tax Code, which includes a complete annotation of recent Revenue Regulations and Revenue Memorandum Circulars, including TRAIN 1 and the latest amendments to RR 2-98, have also been launched. Copies of the new Tax Code have been given to clients and friends.

July 8 was a day of thanksgiving and celebration. BDB Law hopes to continue on its quest to contribute in tax education as it writes in this space for the next decades to come.

*******************************************************

For inquiries on the article, you may call or email

ATTY. IRWIN C. NIDEA, JR.

Senior Partner

T: +63 2 403 2001 loc. 330

This email address is being protected from spambots. You need JavaScript enabled to view it.

Celebrating 10 Wonderful Years of BDB Law

BDB Law marks its 10th Anniversary Milestone.

Together with the partners, their clients, associates, friends and all the people who have been with the firm in this wonderful journey, BDB Law celebrates a decade of passion and hard work in providing a ‘total client care’ service to their valued clients and partners.

The road ahead will be challenging, and the future might be unpredictable, but BDB Law will constantly seek ways to improve and grow; of course, always keeping their clients at the top of their priorities. This is how the firm stays true to the very foundation of its practice – holistic, professional, personal.

BDB Law thanks everyone who took time and joined us in celebrating this memorable milestone. (July 8, 2019, Makati Shangri-La Hotel)

DISCLAIMER: The contents of this Insights are summaries of selected issuances from various government agencies, Court decisions and articles written by our experts. They are intended for guidance only and as such should not be regarded as a substitute for professional advice.

Copyright © 2019 by Du-Baladad and Associates (BDB Law). All rights reserved. No part of this issue covered by this copyright may be produced and/or used in any form or by any means – graphic, electronic and mechanical without the written permission of the publisher.