Atty. Mabel L. Buted discusses the issues that need to be addressed to provide clarity on the requirements needed from the taxpayers on the filing of claims for refund of unutilized creditable withholding taxes.

Issues Related to Refund of Unutilized

Creditable Withholding Taxes

By: Atty. Mabel L. Buted

"This is contrary to the pronouncements by the Courts that in a claim for refund, only the fact of withholding, and not the fact of remittance, must be proven. So the taxpayer need not show that the withholding agent actually remitted the tax withheld. The taxpayer needs only to show that its income had been subjected to withholding. It is, thus, sufficient for the taxpayer to submit the certificate of withholding (BIR Form No. 2307). Whether or not this should be the original and certified true copy is another question."

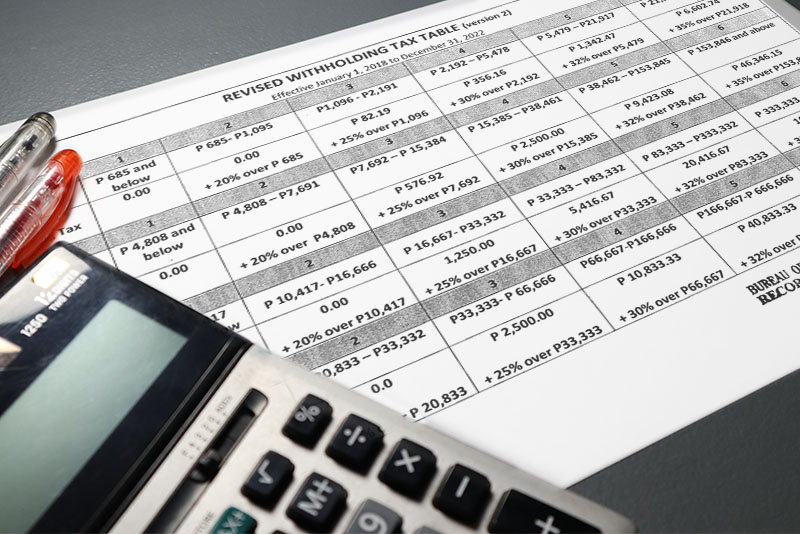

The withholding tax system is a mechanism for which taxes are collected at source as payment of the taxes due from the income recipients. Taxes withheld are advance payments as the taxes are deducted from the income and paid to the tax authority even before the income earner is required to file its tax return. The source of the income is constituted as both a representative of the income recipient for the remittance of taxes and a representative of the government for the collection of taxes. In fact, the withholding agent may be penalized for not doing that obligation.

The tax withheld may either be final tax, where the tax withheld is considered final and the income earner is no longer required to pay tax on the related income. In many instances, however, the tax withheld is simply creditable where the taxpayer is still required to include the income in computing its tax liability and apply the taxes withheld as credit. Because almost all types of income are now subject to withholding taxes, with some at high rates, it is not unusual for income earners to have excess creditable withholding taxes. The taxpayer may either carry—over those excess advance income tax payments to be utilized as credits in the future. The other remedy is to seek reimbursement through a refund.

In applying for refund, taxpayers must consider the basic requirements. These are: (a) the income upon which the taxes were withheld were included as part of the gross income declared in the returns of the taxpayer; (b) the fact of withholding is proven by withholding tax certificates issued by the withholding agents; and (c) the claim, both in the administrative and judicial levels, must be filed within two years from date of payment.

In applying for refund, taxpayers must consider the basic requirements. These are: (a) the income upon which the taxes were withheld were included as part of the gross income declared in the returns of the taxpayer; (b) the fact of withholding is proven by withholding tax certificates issued by the withholding agents; and (c) the claim, both in the administrative and judicial levels, must be filed within two years from date of payment.

Lately, we have noticed that some deviations and concerns have been raised in relation to claims for refund for unutilized creditable withholding taxes. One of these is with respect to the exhaustion of administrative remedies, before resorting to judicial remedies, which was previously discussed by my colleague in this column. We have encountered many others and had likewise been receiving inquiries on this matter.

One of these relates to the documentary requirements. At the administrative level, some applications are being denied for failure to present the originals or the certified true copies of the withholding tax certificates. There are even instances where applications are not accepted simply because they are not accompanied by such documents. Also, while the Courts had consistently declared that proof of remittance of withholding tax by the withholding agents is not required, we still encounter applications being denied at the administrative level simply on the ground that the taxpayer fails to present proofs of remittance of withholding taxes by the withholding agent, such as the latter’s withholding tax returns and alphabetical list of income payees.

This is contrary to the pronouncements by the Courts that in a claim for refund, only the fact of withholding, and not the fact of remittance, must be proven. So the taxpayer need not show that the withholding agent actually remitted the tax withheld. The taxpayer needs only to show that its income had been subjected to withholding. It is, thus, sufficient for the taxpayer to submit the certificate of withholding (BIR Form No. 2307). Whether or not this should be the original and certified true copy is another question.

There is no specific issuance that enumerates and clarifies the requirements when applying for refund of unutilized withholding taxes. It is time to have one to properly guide both the taxpayers and the BIR examiners in dealing with refund claims. In doing so, however, practices that had already be settled through Court decisions should be respected.

On giving the administrative claim a chance to be acted upon before elevating to the Courts, the CREATE law provided for a specific period to process and decide on refund claims. But this was vetoed. So as it stands now, the law does not provide a specific period within which an administrative claim should be acted upon. The rule remains that the refund for income taxes due to excessive withholding should be filed within two years, both administratively and judicially. Hence, a taxpayer may already invoke the jurisdictions of the Courts if that period is about to lapse, even if there is no decision yet on the administrative claim.

This notwithstanding, it is a common practice for the tax authority to argue pre-mature filing of judicial claims pending the decision at the administrative level. And as noted above, there also seems to be some Court decisions holding that the claim at the administrative level should be given sufficient time to be acted upon before it is considered denied by inaction.

I agree that the tax authority should be given a chance to review applications for refund and to issue decision or before it is considered effectively denied through inaction. And we’ve seen that necessity during this pandemic. The difficulty in the preparations and filing leaves no option but for the taxpayer to file at the last minute, and to meet the 2-year period for judicial action, elevates the same to the Court after only a few days. But that’s how the law is presently crafted. And even if a period should be granted to the tax authority to review, how long would that be? The law does not say.

These are just a few of the concerns related to claims for refund of unutilized advance income tax payments. There are many others. Some can be addressed through administrative issuances. But others need legislative intervention. I hope that these can be addressed to provide clarity on the requirements needed from the taxpayers and on the processing of claims by the tax authorities.

The author is a junior partner of Du-Baladad and Associates Law Offices (BDB Law), a member-firm of WTS Global.

The article is for general information only and is not intended, nor should be construed as a substitute for tax, legal or financial advice on any specific matter. Applicability of this article to any actual or particular tax or legal issue should be supported therefore by a professional study or advice. If you have any comments or questions concerning the article, you may e-mail the author at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 8403-2001 local 312.