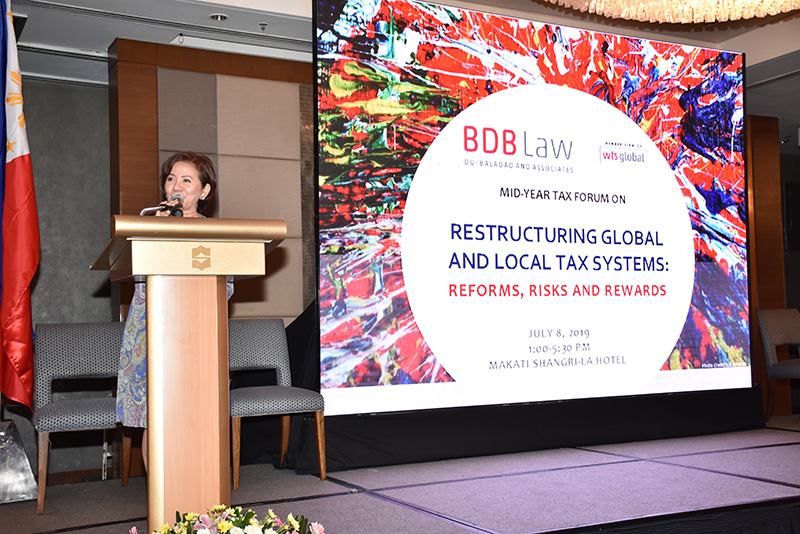

2019 Mid-Year Tax Forum

As part of its 10th Anniversary Milestone celebration and as a gesture of gratitude to its clients and partners, BDB Law sponsored a Mid-Year Tax forum which focused and discussed 3 emerging topics and developments in the field of taxation:

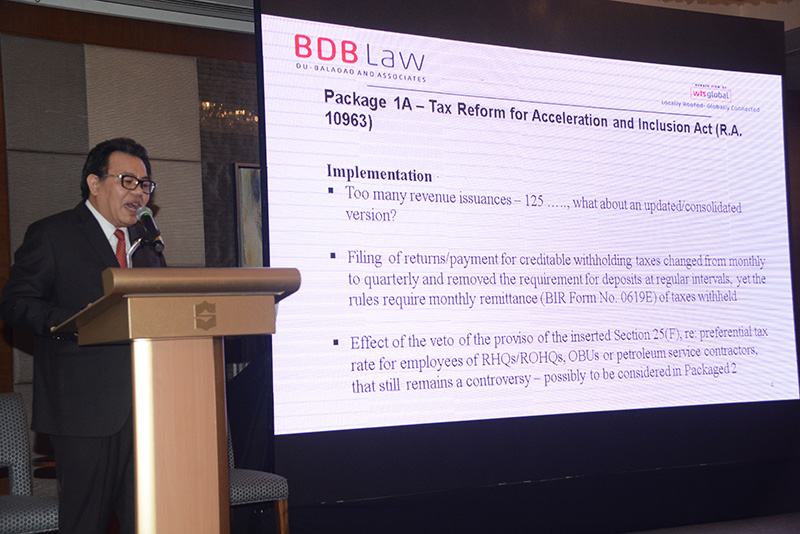

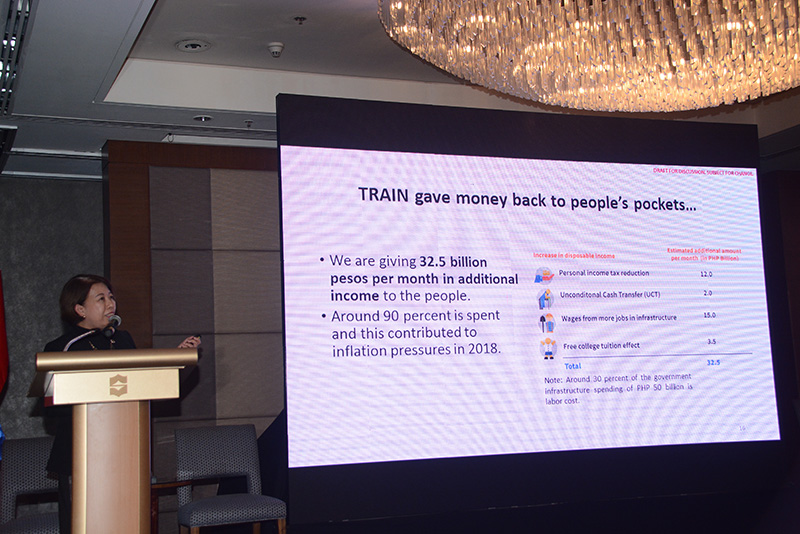

- Boarding the Tax Train: After the first stage of Tax Reform for Acceleration and Inclusion Act Law implementation, there is now sufficient period to assess its effect and the challenges in making it work. The next phase will soon follow, and the question is whether we are prepared for the next wave of reforms and what safety nets are provided to ensure that broad economic activities will not suffer from unintended consequences.

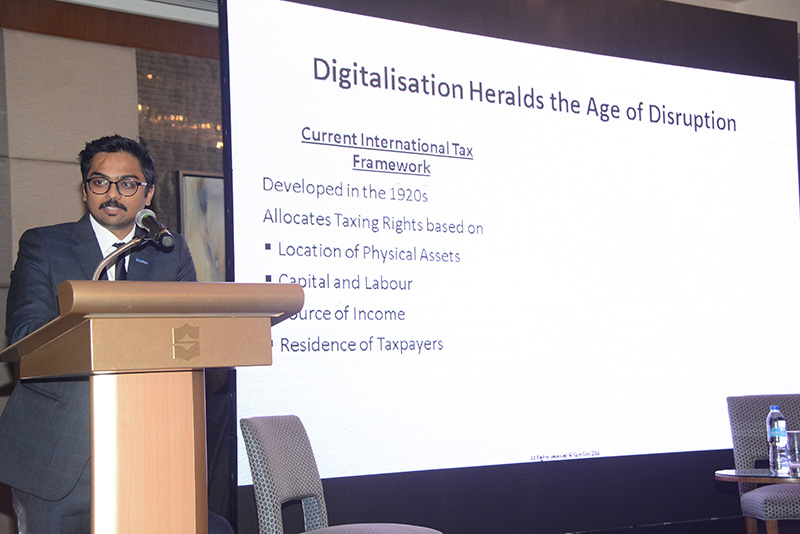

- Taxing the Digital: The Rise of Fin-Techs and Plugging the Digital Leaks. The rise of e-commerce, use of cryptocurrencies and blockchain technology present tax compliance challenges for both the businesses and governments. Plugging the tax leaks requires sophisticated tax analytics and digital responses that will rely heavily on cross-border collaboration. The question is how.

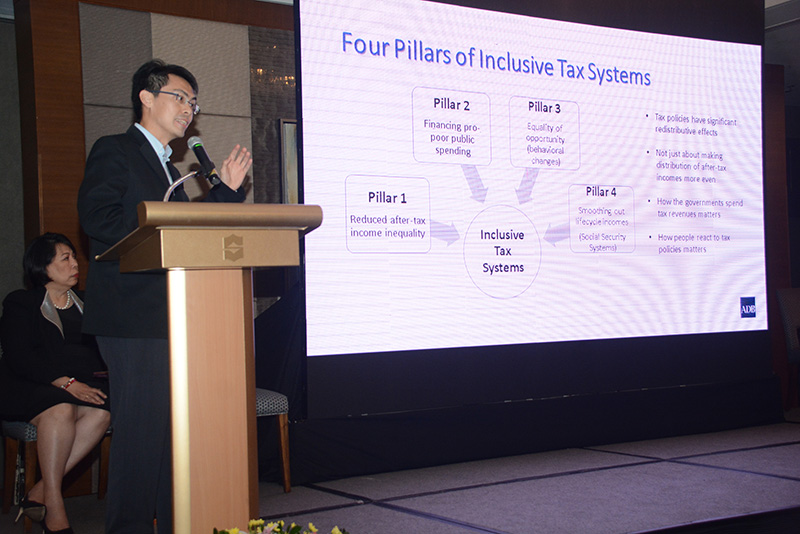

- Tilting the Balance Towards Transparent, Sustainable and Inclusive Taxation Policies: Enforcement of greater transparency in reporting and ensuring that the tax revenues will go towards improving the quality of life of the citizens are issues that are driving tax policies. Companies need to brace themselves for these developments and start re-assessing business and tax strategies in light of the future demand for public disclosures of tax information.

It was indeed an afternoon of lively discussion and knowledge sharing among local and global experts, thought leaders and stakeholders in the field. This was attended by more than 250 clients, partners, tax experts, business leaders, government officials, regulators, and policymakers. (July 8, 2019, Makati Shangri-La Hotel)