MARCH• VOL. 3 • SERIES OF 2021

INSIGHTS is a monthly publication of BDB LAW to inform, update and provide perspectives to our clients and readers on significant tax-related court decisions and regulatory issuances (includes BIR, SEC, BSP and various government agencies).

DISCLAIMER: The contents of this Insights are summaries of selected issuances from various government agencies, Court decisions and articles written by our experts. They are intended for guidance only and as such should not be regarded as a substitute for professional advice.

Copyright © 2021 by Du-Baladad and Associates (BDB Law). All rights reserved. No part of this issue covered by this copyright may be produced and/or used in any form or by any means – graphic, electronic and mechanical without the written permission of the publisher.

What's Inside ...

- HIGHLIGHTS FOR FEBRUARY 2021

- SIGNIFICANT COURT DECISIONS

- Supreme Court

- Court of Tax Appeals

- SIGNIFICANT REGULATORY ISSUANCES

- Bureau of Internal Revenue

- Securities And Exchange Commission

- Bangko Sentral Ng Pilipinas

- Insurance Commission

- PUBLISHED ARTICLE

- Is CREATE the Answer?

- OUR EXPERTS

- The Personalities

- The Personalities

HIGHLIGHTS for FEBRUARY 2021

SUPREME COURT DECISIONS

- An absorbed entity in a merger is considered not dissolved prior to it obtaining a tax clearance, but only for tax purposes. (Axia Power Holdings Philippines Corporation v. CIR, G.R. No. 230847, October 14, 2020)

- A taxpayer claiming for a refund of its unutilized input VAT from zero-rated transactions must show that it has an excess input VAT over the output VAT. Prior years’ excess credits cannot be used to offset the current output vat unless they are substantiated. (Total (Philippines) Corporation v. CIR, G.R. No. 247341, November 18, 2020)

COURT OF TAX APPEALS DECISIONS

- What is allowed to be appealed before the CTA is a denial or partial denial, not a grant, of a claim for VAT refund. (Commissioner of Internal Revenue v. Northwind Power Development Corporation, CTA EB No. 2151, January 21, 2021)

- The presentation of both Foreign Articles/Certificate of Incorporation and SEC Certificate of Non-Registration will ordinarily prove that an entity is a foreign corporation not doing business in the Philippines, except when there is clear and convincing evidence that would prove otherwise. (Amadeus Marketing Philippines, Inc. v. Commissioner of Internal Revenue, CTA EB No. 2137, January 26, 2021)

- The taxpayer is allowed to introduce evidence in the judicial proceedings which was not presented during the administrative proceedings, provided that the denial of the VAT refund is not due to failure to submit complete documents despite notice or request. (CIR v. CE Luzon Geothermal Power Company, Inc., CTA EB No. 2132, January 28, 2021)

- Courts cannot grant a relief not prayed for in the pleadings or in excess of what is being sought by a party to a case. (Ginebra San Miguel, Inc. v. CIR, CTA Case Nos. 8953 & 8954, February 1, 2021)

- The rule under RR 12-99 that non-response to a notice sent by registered mail within the prescribed period from date of the posting thereof in the mail is to be considered actually or constructively received by the taxpayer presumes that the notice was sent to the correct address. (CIR v. Vitalo Packaging International, Inc., CTA EB No. 2148, February 3, 2021)

- The FAN /FLD must be received by the taxpayer or its authorized representative. (CIR v. Vitalo Packaging International, Inc., CTA EB No. 2148, February 3, 2021)

- Domestic purchases of goods and services that were destined for consumption within the ecozone are deemed exports of a taxpayer’s suppliers and should be free of VAT; hence, no input VAT should therefore be paid on such purchases. (Wells Fargo Enterprise Global Services, LLC-Philippines v. CIR, CTA Case No. 9849, February 8, 2021)

- If the BIR decided to enforce the collection of unpaid tax through judicial action, particularly through the filing of a criminal charge before the DOJ, an assessment is not necessary. (People v. Garcia, CTA Crim. Case Nos. O-572, O-573 & O-610, February 15, 2021)

- Considering that the Court En Banc has appellate jurisdiction over decisions and resolutions of the Court in Division, it follows that it also has the power to issue all auxiliary writs in the exercise of said jurisdiction. (Commissioner of Internal Revenue v. Court of Tax Appeals - Second Division, CTA EB No. 2062, February 16, 2021)

- Actions for tax refund or credit are in the nature of a claim for exemption and the law is not only construed in strictissimi juris against the taxpayer, but also the pieces of evidence presented entitling a taxpayer to an exemption must be strictly scrutinized and duly proven. (Amadeus Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 9664, February 22, 2021)

- A motion for reconsideration of the denial of the administrative protest does not toll the 30-day period to appeal to the CTA. (B. Nevalga Enterprises Corp. vs. Bureau of Internal Revenue, CTA EB No. 2171 (CTA Case No. 10159), February 19, 2021)

- The Rules of Court apply suppletorily to the CTA’s own rule. (Commissioner of Internal Revenue vs. Amparo Shipping Corporation (CTA EB No. 2165 (CTA Case No. 9387), February 23, 2021)

- A taxpayer claiming a tax credit or refund has the burden of proof to establish the factual basis of that claim. (Commissioner of Internal Revenue vs. Colt Commercial Inc. CTA EB No. 2163 (CTA Case No. 9340), CTA EB No. 2164 (CTA Case No. 9340), February 22, 2021)

- Before the collection of a deficiency tax, due process requires that the taxpayer must be informed in writing of the law and facts upon which the assessment was made and be given the opportunity to respond and contest the same. (EHS Lens Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 9924, February 23, 2021)

- A MOA cannot be a valid substitute for the required LOA. (Exclusive Networks-PH Inc. vs. Commissioner of Internal Revenue, CTA Case No. 9689, February 23, 2021.)

- The filing of an administrative appeal before the CIR does not give the taxpayer a fresh 180-day period, despite the lapse of the original 180-day period. (Larry E. Segaya vs. Commissioner of Internal Revenue, CTA Case No. 9875, February 26, 2021)

- To be entitled to refund or tax credit of input tax due or paid attributable to zero-rated or effectively zero-rated sales, the requirements laid down in Section 112 (A) and (C) of the NIRC must be satisfied. (MTI Advanced Test Development Corporation vs. Commissioner of Internal Revenue, CTA Case No. 9690, February 23, 2021.)

BIR ISSUANCES

- RMC No. 18-2021, January 27, 2021 – Clarification on the filing of BIR Form Nos. 1604-CF, 1604E and Other Matters.

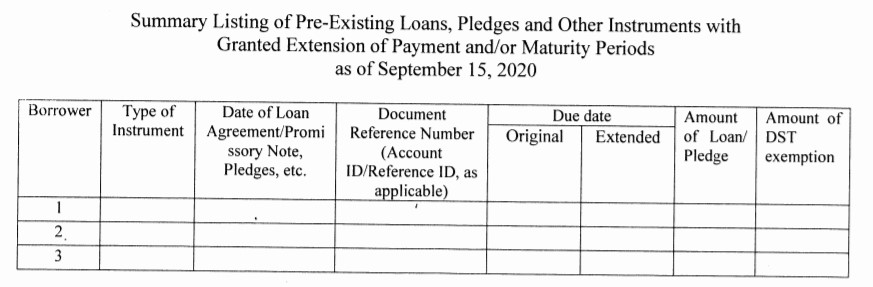

- RMC No. 22-2021, February 18, 2021 – Reportorial Requirements on the Exemption from DST Relief for qualified loans pursuant to RR No. 24-2020.

- RMC No. 26-2021, February 24, 2021 – Extension of the submission of summary listing in relation to RMC No. 22-2021.

- RMO No. 8-2021, January 27, 2021 – New Policies and Procedures in the Issuance of Notice of Denial of the application for compromise settlement cases.

SEC ISSUANCES

- SEC-OGC Opinion No. 21-01, January 18, 2021 – The 2 remaining members of the Board cannot fill-up the vacancies left by the three (3) other members who all resigned, on the ground that the remaining 2 trustees will no longer constitute a quorum of the Board.

BSP ISSUANCES

- Memorandum No. M-2021-011, February 2, 2021 – Reclassification of Debt Securities Measured at Fair Value to the Amortized Cost Category.

- Memorandum No. M-2021-012, February 5, 2021 – Extension of Temporary Measures Implemented in the Bangko Sentral ng Pilipinas (BSP) Rediscounting Facilities.

- BSP Circular No. 1109, February 4, 2021 – Amendments to the Regulations on Investments Management Activities.

- Circular Letter No. CL-2021-013, February 10, 2021 – Dissemination of AMLC Regulatory Issuances on the Amendments to Certain Provisions of the 2018 Implementing Rules and Regulations (IRR) of the AMLA, as amended.

- Circular Letter No. CL-2021-015, February 17, 2021 – Announces the Celebration of Banker’s Institute of the Philippines, Inc. (BAIPHIL) Training and Development Week.

IC ISSUANCES

- Legal Opinion No. 2021-04, January 14, 2021 – Legal Opinion on Geographical Limitation in accordance with IC Circular Letter No. 2020-109.

- Insurance Commission Ruling No. 2021-01, February 5, 2021 – Guidance on the Application of PFRS and Circular Letter No. 2020-22.

- Circular Letter No. 2021-06, January 26, 2021– Guidelines on the Electronic Submission of Requests for Investment Approval, Compliance with Security Deposit Requirements and Filing of Reportorial Requirements.

- Circular Letter No. 2021-09, February 16, 2021 – Guidelines on Electronic Commerce of Pre-need Companies.

- Circular Letter No. 2021-10, February 16, 2021 – Guidelines on Electronic Commerce of HMO Products.

- Circular Letter No. 2021-11, February 17, 2021 – Guidelines on the Adoption of a Regulatory Sandbox Framework for Financial Technology (FinTech) Innovations for HMOs and Pre-need Companies.

An absorbed entity in a merger is considered not dissolved prior to it obtaining a tax clearance, but only for tax purposes.

The SEC approved the merger of Marubeni Energy Services Corporation (MESC) with Axia Power Holdings Philippines Corporation without the requisite tax clearance submitted by MESC. On the issue of whether MESC had legal personality to file the administrative claim for tax refund or tax credit with the CIR, the CTA En Banc held that MESC ceased to exist when its merger with Axia was approved by the SEC. Since MESC no longer had legal personality to do so, no administrative claim can be considered filed, and no suit or proceeding can be maintained in any court for the recovery of the tax.

Sec. 80 of the Corporation Code provides that one of the effects of merger is the cessation of the separate existence of the constituent corporations. Hence, upon approval by the SEC of the merger in this case, MESC's legal personality, was dissolved. Secs. 52 and 235 of the Tax Code, however, provides that corporations shall not be dissolved until cleared of any tax liability. Thus, the Supreme Court (SC) held that MESC is considered not dissolved prior to its obtaining a tax clearance, but only for tax purposes and thus had legal personality to file a claim for tax refund or issuance of tax credit with the BIR. Not only is this interpretation within the spirit of the NIRC, it is also similar to Sec. 122 of the Corporation Code which allows a corporation whose corporate existence has been terminated to nonetheless continue performing limited activities for a period of three (3) years from its dissolution. If a corporation is allowed to carry on certain activities for its own benefit and the benefit of its stakeholders after dissolution, there should be nothing to prevent a corporation from maintaining a limited existence if only to serve the public interest in settling its tax liabilities. (Axia Power Holdings Philippines Corporation v. CIR, G.R. No. 230847, October 14, 2020)

A taxpayer claiming for a refund of its unutilized input VAT from zero-rated transactions must show that it has an excess input VAT over the output VAT.

The core of the issue is the presence of the fourth requisite to validly claim a refund or tax credit of unutilized input VAT, that is, whether the valid input VAT attributable to petitioner's zero-rated sales has not been applied against its output VAT liability. Taxpayer claims that there is no law or regulation requiring that input VAT must first be proven to exceed output VAT for a claim of refund to prosper.

The SC held that Section 110(B) of the NIRC, as amended, when taken together with Section 112 of the NIRC, as amended, shows that a taxpayer must have excess input VAT amount to cover its output VAT liability for the pertinent period or periods to apply for a refund. In other words, a taxpayer claiming for a refund of its unutilized input VAT from zero-rated transactions must show that it has an excess input VAT over the output VAT. Moreover, a closer reading of Section 112(A) of the NIRC, as amended, shows that the excess or unutilized input VAT from zero-rated transactions may be refunded or credited to other internal revenue taxes to the extent that it has not been applied against the output tax. (Total (Philippines) Corporation v. CIR, G.R. No. 247341, November 18, 2020)

What is allowed to be appealed before the CTA is a denial or partial denial, not grant, of a claim for VAT refund.

Taxpayer filed a Motion to Withdraw its Petition for Review of CIR's partial denial of the former's claim for refund of excess and unapplied input VAT. Alleging that while he did not have any opposition to the taxpayer's Motion to Withdraw, the Court in Division should have resolved the merits of the CIR’s counterclaim (i.e., that taxpayer's claim for refund should be denied in its entirety, instead of being only partially denied at the administrative level). In insisting that the Court in Division had jurisdiction to rule on its counterclaim, the CIR argues that the Petition for Review filed by taxpayer pertains to the entire decision issued by the BIR on its input VAT refund claim such that the granted portion of said claim may also be adjudicated upon.

The CTA en banc ruled that Section 112(C) of the Tax Code expressly provides that what is appealable before this Court is a full denial or partial denial of a VAT refund claim. Thus, CIR cannot raise any issue on the granted portion of the VAT refund claim. Since the right to appeal is a statutory right, matters and issues that can be appealed are limited to those provided under the law. Considering that a granted VAT refund claim is not one of those specifically mentioned under Section 112(C) of the Tax Code which can be appealed before the CTA, the Court cannot entertain any issue or question raised thereon. (Commissioner of Internal Revenue v. Northwind Power Development Corporation, CTA EB No. 2151, January 21, 2021)

Cases involving only questions of law, between and among departments, bureaus, offices, agencies and instrumentalities of the National Government, including GOCCs, shall be submitted to and settled or adjudicated by the Secretary of Justice (SOJ).

Taxpayer, a government-owned and controlled corporation (GOCC), filed its Petition for Review before the Court in Division, assailing the BIR's Decision affirming the Final Decision on Disputed Assessment against taxpayer. The BIR filed its Answer interposing that the case pertains to a tax dispute between government agencies, including GOCCs, involving purely questions of law. In such a case, the Secretary of Justice has jurisdiction to settle or adjudicate the tax dispute.

The Court en banc held that the CTA has no jurisdiction to hear, try and decide the petition filed by the taxpayer. Under Sections 66, 67, and 68 of Chapter 14, Book IV of the Administrative Code of 1987, cases involving only questions of law, between and among departments, bureaus, offices, agencies and instrumentalities of the National Government, including GOCCs, shall be submitted to and settled or adjudicated by the Secretary of Justice (SOJ).

In order to harmonize the seemingly conflicting provisions of the NIRC of 1997 and PD No. 242 (which is now embodied in Chapter 14, Book IV of the Administrative Code of 1987), the Supreme Court has adopted the following interpretation in cases involving disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties in relation thereto, or other matters arising under the NIRC or other laws administered by the BIR, to wit:

1. As regards private entities and the BIR, the decision of petitioner is subject to the exclusive appellate jurisdiction of this Court, in accordance with Section 4 of the NIRC; and

2. Where the disputing parties are all public entities, the case shall be governed by PD No. 242 where the dispute shall be administratively settled or adjudicated by the Secretary of Justice, the Solicitor General, or the Government Corporate Counsel, depending on the issues and government agencies involved. (Philippine Pharma Procurement, Inc. v. BIR, CTA EB No. 2096, January 25, 2021)

Note: (Dissenting Opinion of Ringpis-Liban, J.) The only way to harmonize two (2) seemingly contradictory laws it to declare that when the controversy between or among government offices, agencies and instrumentalities, including GOCCs involve any of the matters listed in Section 7(a) of R.A. No. 9282, then it is the CTA who has exclusive appellate jurisdiction. All other controversies between or among the aforementioned parties that do not involve taxation matters or interpretation of the provisions of the NIRC of 1997, as amended, may properly follow the procedure for administrative settlement or adjudication of disputes laid down in P.D. No. 242 and the Administrative Code of 1987. Thus, the instant Petition for Review should be granted.

The presentation of both Foreign Articles/Certificate of Incorporation and SEC Certificate of Non-Registration will ordinarily prove that an entity is a foreign corporation not doing business in the Philippines, except when there is clear and convincing evidence that would prove otherwise.

The CIR argues that the Court in Division erred in not disallowing taxpayer's sale of services to Amadeus IT Group SA on the ground that the latter is an entity doing business in the Philippines. The CIR invokes the Court En Banc's ruling in a previous case involving the same taxpayer.

The Court En Banc agrees with the Court in Division and the taxpayer that, as a general rule, the presentation of both Foreign Articles/Certificate of Incorporation and SEC Certificate of Non-Registration will ordinarily prove that an entity is a foreign corporation not doing business in the Philippines. However, an exception to this rule is when there is clear and convincing evidence that would prove otherwise. To reiterate, one of the pieces of evidence submitted by the taxpayer is its ACO Agreement which is replete with provisions that signified Amadeus IT Group SA's participation in running the marketing and distribution of the Amadeus System in the Philippines. Clearly, the ACO Agreement paved the way for Amadeus IT Group SA, with the taxpayer, to further advance its purpose to continually promote, market, and distribute the Amadeus System in the Philippines. These and its powers fall squarely under the definition of "doing business in the Philippines" under Section 3(d) of Republic Act No. 7042. Hence, all sales of service rendered to it do not qualify for VAT zero-rating. (Amadeus Marketing Philippines, Inc. v. Commissioner of Internal Revenue, CTA EB No. 2137, January 26, 2021)

The date of the post office stamp on the envelope or the registry receipt is considered the date of filing of a pleading sent by registered mail.

As found by the CTA Third Division, taxpayer's administrative protest was timely filed by registered mail on May 17, 2013. The CIR asserts that the administrative protest was filed out of time, having been dispatched only on June 19, 2013 as contained in the Certification by postmaster Mr. Quiogue.

The CTA en banc ruled that the administrative protest was timely filed. The Certification was only with respect to the dispatch of said mail matter on June 19, 2013. Clearly, taxpayer's protest was filed through registered mail on May 17, 2013, notwithstanding its dispatch by the Post Office only on June 19, 2013. This is in accordance with Section 3, Rule 13 of the Revised Rules of Court which states that the date of the post office stamp on the envelope or the registry receipt is considered the date of filing of a pleading sent by registered mail. (Commissioner of Internal Revenue v. Lorenzo Shipping Corporation, CTA EB No. 1964, January 26, 2021)

A motion for reconsideration of the resolution of a Motion to Quash Information, being meritorious motion, should be filed within a non-extendible period of five (5) days from receipt of the adverse resolution.

The taxpayer separately filed three (3) Motions to Quash lnformation arguing that the government's right to file an action has already prescribed. Acting on the said Motions, the Court in Division issued a Resolution dated November 8, 2019 granting respondent's Motions and dismissing the subject consolidated cases on the ground of prescription. Petitioner filed a Motion for Reconsideration (MR) only on November 29, 2019.

The CTA en banc ruled that the petitioner filed its MR out of time. The Revised Guidelines for Continuous Trial of Criminal Cases which is applicable to all newly-filed criminal cases in the CTA, pertinently provides that a motion for reconsideration of the resolution of a meritorious motion should be filed within a non-extendible period of five (5) days from receipt of the adverse resolution; otherwise, the said motion shall be denied outright. Considering that the taxpayer's Motions to Quash Information are meritorious motions pursuant to Item 111(2)(c)(v) of the Revised Guidelines, petitioner has a non-extendible period of five (5) days from receipt of the adverse Resolution to file its motion for reconsideration. (People of the Philippines v. Ulysses Palconet Consebido, CTA EB Crim. No. 076, January 27, 2021)

While tax cases are practically imprescriptible, such doctrine only applies for as long as the period from the discovery and institution of judicial proceedings for its investigation and punishment, up to the filing of the information in court does not exceed five (5) years.

The BIR filed a Complaint Affidavit with the DOJ on January 30, 2014 then separately filed three lnformations before the Court in Division on March 18, 2019. The taxpayer insists that the five-year prescriptive period for criminal violation under the NIRC of 1997 began when the case was referred to the DOJ for preliminary investigation.

The CTA en banc ruled that prescription had already set in when BIR separately filed the three lnformations before the Court in Division. The Supreme Court has considered both the fact of discovery of the offense and the institution of judicial proceeding for investigation and punishment as significant in determining the commencement of the five-year prescriptive period of the Tax Code. It is likewise provided that the preliminary investigation is considered a proceeding for investigation and punishment of a crime which commences the period for prescription.

While tax cases are practically imprescriptible, such doctrine only applies for as long as the “period from the discovery and institution of judicial proceedings for its investigation and punishment, up to the filing of the information in court does not exceed five (5) years". Considering that in the instant case, the period from the filing of the preliminary investigation with the DOJ up to the filing of the Informations before the Court in Division exceeded five (5) years, the BIR is barred from instituting the subject tax cases against respondent. (People of the Philippines v. Ulysses Palconet Consebido, CTA EB Crim. No. 076, January 27, 2021)

No evidentiary value can be given to any documentary evidence that is merely attached to the records of the case as the rules on documentary evidence require that such documents must be formally offered before the Court.

Taxpayer argues that based on the evidence presented during trial, it was shown that Petron passed on the excise taxes to the taxpayer and that Petron paid said excise taxes to the BIR; thus, the taxpayer is entitled to a refund. The taxpayer further contends that the Court shall recognize the BIR letter although not formally offered in evidence because the said letter contains the BIR Regional Office's finding on the payment of excise taxes by Petron.

The CTA en banc agrees with the findings of the Court in Division that the taxpayer is not entitled to refund because it failed to prove that Petron paid to the BIR the excise taxes due on petroleum products it sold to the taxpayer and that the said excise taxes were substantially charged to and paid by the taxpayer. The Court finds that the sales invoices, cash receipts, and accounts payable vouchers supporting the ICPA-recommended amount of refund do not show any indication that the fuel prices charged by Petron against the taxpayer included the excise taxes imposed on the petroleum products. Neither did the taxpayer offer its Supply or Sales Agreement with Petron which would show that the amounts billed by Petron to taxpayer per the sales invoices are inclusive of excise taxes. Moreover, the taxpayer failed to establish that Petron actually paid the said excise taxes to the BIR.

As to the BIR letter, the Court en banc has declared that, being a court of record, cases filed before it are litigated de novo, party-litigants must prove every minute aspect of their cases. Indubitably, no evidentiary value can be given to any documentary evidence that is merely attached to the records of the case as the rules on documentary evidence require that such documents must be formally offered before the Court. (Philippine Associated Smelting and Refining Corporation v. CIR, CTA EB No. 2172, January 27, 2021)

A PAN delivered to a different entity is not an actual receipt of the taxpayer under audit and constitutes a denial of such taxpayer's right to due process.

The CIR argues that the fact of mailing of the PAN was supported by the corresponding Master List of Mail Matters and even a certification from the Post Office. If indeed the onus probandi had shifted to the CIR, he maintains his position that he has sufficiently proven with overwhelming evidence that respondent indeed received the PAN in the due course of mail. The Court in division found that a perusal of the Certification proves that the letter was addressed and delivered to a certain Mindanao Sanitarium and Hospital. Records reveal that the taxpayer and Mindanao Sanitarium and Hospital, Inc. are two different entities.

The CTA en banc held that there is no actual receipt of PAN by the taxpayer. A PAN is part of the due process rights of taxpayer. Absence of PAN renders any assessment void. Taxpayer did not receive the subject PAN because it was addressed and delivered to a different entity. Such omission by CIR constitutes a denial of taxpayer's right to due process. Hence, the subject assessment is void. (CIR v. Mindanao Sanitarium and Hospital College, Inc., CTA EB No. 2139, January 27, 2021)

A general averment that the taxpayer failed to comply with the invoicing requirements cannot supplant the findings of the Court which was a result of a detailed examination of the pieces of evidence adduced by the taxpayer.

The CIR merely alleged that taxpayer is not entitled to the VAT refund granted to it by the Court in division due to a supposed failure to comply with the invoicing requirements under Sections 110 and 113 of the Tax Code. He did so by merely quoting the legal provisions requiring such compliance but did not specify which requirements taxpayer failed to comply. The CIR further argues that the taxpayer should not be allowed to present evidence which were not submitted at the administrative level.

The CTA en banc ruled that CIR's general averment that the taxpayer failed to comply with the invoicing requirements cannot supplant the findings of the Court which was a result of a detailed examination of the pieces of evidence adduced by the taxpayer. In order for CIR to reverse a factual finding made by the Court, he must pinpoint specific competent evidence showing the contrary. The Court’s findings are accorded the highest presumption of regularity which can only be overturned by clear and convincing evidence. (CIR v. CE Luzon Geothermal Power Company, Inc., CTA EB No. 2132, January 28, 2021)

The taxpayer is allowed to introduce evidence in the judicial proceedings which was not presented during the administrative proceedings, provided that the denial of the VAT refund is not due to failure to submit complete documents despite notice or request.

The taxpayer’s VAT refund claims for the first, third, and fourth quarters of taxable year 2003 were deemed denied due to inaction by CIR. On the other hand, the VAT refund claim for the second quarter of TY2003 was denied by petitioner allegedly because it was carried over to the succeeding periods. The Court considered all of the evidence presented by taxpayer to substantiate its claims for VAT refund for the said periods even though these have not been presented before the CIR at the administrative level. The CIR argues that the taxpayer should not be allowed to present evidence which were not submitted at the administrative level.

The CTA en banc discussed that a distinction must be made between a) an administrative VAT refund claim that was dismissed due to failure to submit complete documents despite notice or request; and b) administrative VAT refund claims that were either deemed denied due to inaction or denied by CIR other than due to failure to submit complete documents despite notice or request. In the first instance, a taxpayer-claimant must show this Court during the judicial proceedings not only his entitlement to a VAT refund under substantive law, but that he also submitted complete documents as requested by CIR. In the second instance, a taxpayer-claimant may present all evidence to prove its entitlement to a VAT refund, and the Court will consider all evidence offered even those not presented before CIR at the administrative level. In this case, since the denial of the VAT refund is not due to failure to submit complete documents despite notice or request, the Court may consider all evidence presented by taxpayer in the judicial proceedings to support its claim for VAT refund (CIR v. CE Luzon Geothermal Power Company, Inc., CTA EB No. 2132, January 28, 2021).

Sending of a notice of assessment to the taxpayer's old office address, despite the BIR's prior knowledge of its new principal place of business, is tantamount to a failure in service of the assessment, thereby making the assessment invalid.

Taxpayer's old address was at Pasig City. In 2009, a BIR Certificate of Registration was issued to the taxpayer indicating its registered address as Binan Laguna. The BIR indicated taxpayer's old address in the subject PAN, and the FLD. Taxpayer points out that there was no proper service of the originals of the PAN and FLD /FAN since the said notices were received by it, not through the CIR, but through its former landlord.

The CTA ruled that sending of a notice of assessment to the taxpayer's old (and therefore improper) office address, despite the BIR's prior knowledge of its new principal place of business, is tantamount to a failure in service of the assessment, thereby making the assessment invalid. As early as 2009, CIR already had knowledge of taxpayer's new address in Laguna. if the taxpayer fails to inform the BIR of its change of address, any communication previously sent to its former legal residence or place of business shall be considered valid and binding for purposes of the period within which to reply. Conversely, if the taxpayer does his duty and duly informs the BIR of its change of address, then any communication sent to its old address becomes invalid and tolls the period within which the taxpayer is given to reply. Furthermore, CIR failed to establish that the landlord who received the notices in the former premises and old address of Petitioner was, in fact, an authorized representative of taxpayer in accordance with Section 3.1.4 of RR 12-99. (Resource One Corporation v. CIR, CTA Case No. 9423, January 29, 2021)

Taxpayer should secure VAT-registered official receipts from the third-party service providers relative to reimbursable expenses in order for the former to claim the related input tax.

To support its claim for refund of input tax, the taxpayer presented non-VAT official receipts from NGCP containing a statement that "[t]his document is not valid for claim of input taxes except for VAT on ancillary services collected for the account of other third-party service provider."

The CTA disallowed the input tax on purchases of services from NGCP because these are supported with non-VAT official receipts. If NGCP collected from the taxpayer the payment and the corresponding VAT on account of other third party service providers, NGCP and such third party service provider should have nonetheless complied with the conditions laid down in RMC 9-2006 which specifically requires that VAT registered official receipts be issued in the name of the ultimate customer in order for the latter to claim the related input tax. Accordingly, the taxpayer should have secured VAT-registered official receipts from the third-party service providers relative to such reimbursable expenses. (Maibarara Geothermal, Inc. v. CIR, CTA Case No. 9662, January 29, 2021)

Courts cannot grant a relief not prayed for in the pleadings or in excess of what is being sought by a party to a case.

In its Motion for Reconsideration, the taxpayer included an additional assertion in its prayer that the Court further considers the ICPA's recommendation to include in the taxpayer’s claim for refund a) excise taxes on finished goods apparently not included in the claim for refund but which should have been part thereof, as the finished goods were produced exclusively from the 2012 year-end inventories and alcohol purchases from period January 8, 2013 to February 15, 2013 within the period of the claim; and b) excise taxes on ethyl alcohol apparently not included in the claim for refund but which should have been part thereof, as the alcohol was already in transit during petitioner's 2012 year-end inventory count and was reflected in the January 2013 Official Registry Book.

The CTA cannot grant such relief. It is well-settled that courts cannot grant a relief not prayed for in the pleadings or in excess of what is being sought by a party to a case. It is improper to enter an order which exceeds the scope of relief sought by the pleadings, absent notice which affords the opposing party an opportunity to be heard with respect to the proposed relief. The fundamental purpose of the requirement that allegations of a complaint must provide the measure of recovery is to prevent surprise to the defendant. (Ginebra San Miguel, Inc. v. CIR, CTA Case Nos. 8953 & 8954, February 1, 2021).

On the basis of the provisions of the WTO Agreement, beginning July 1, 2017, since the Philippines' Special Treatment for rice has already expired, there is no need for taxpayer to secure a prior Import Permit from the NFA to import rice.

On several dates in May 2018, three (3) shipments of white rice were consigned to the taxpayer. Various customs officers issued Reports of Seizure against the subject shipments for alleged lack of NFA Import Permits prior to importation. The taxpayer prays that the Bureau of Customs (BOC) refund the costs of taxpayer's rice importations forfeited by the latter in the three (3) forfeiture cases and sold in public auction amounting to P112,874,700.00. BOC invokes the provisions of the Memorandum Circular No. A0-20 17-08-002 dated August 4, 2017 of the NFA, specifically as regards the requirement of prior issuance of an import permit for the importation of rice.

The Court ruled that there is no need for taxpayer to secure Import Permits from the NFA for the subject shipments. Pursuant to the WTO Agreement, which was concurred in by the Senate and became "a part of the law of the land", WTO member countries like the Philippines are prohibited from imposing quantity restrictions (QRs) on imported products. However, certain countries were accorded a Special Treatment allowing them to impose discretionary import licensing, which was until June 30, 2017 in the Philippines’ case. Thus, on the basis of the provisions of the WTO Agreement, beginning July 1, 2017, since the Philippines' Special Treatment for rice has already expired, the prohibition from imposing QRs on imported rice has already taken effect. As a consequence, there was no need for taxpayer to secure a prior Import Permit from the NFA to import rice, beginning on the said date.

The NFA's Memorandum Circular No. A0-2017-08-002 dated August 4, 2017 governs only the "in quota" importations of rice and does not cover "out-quota" importations thereof. Since the subject importations of taxpayer have been identified by the NFA as "out-quota", there is no need for the latter to issue import permits therefor under Memorandum Circular No. A0-20 17-08-002 dated August 4, 2017. (Sta. Rosa Farm Products Corporation v. Commissioner of Customs, CTA Case No. 9932, February 3, 2021)

When the 120-day period to act on an administrative claim for tax credit or refund under Section 112(C) of the Tax Code lapses and there is inaction on the part of the CIR, the taxpayer must no longer wait for the CIR to come up with a decision as his inaction is the decision itself.

Taxpayer filed with the BIR its administrative claims for the issuance of TCCs, for excess and unutilized input value-added tax (VAT) attributable to zero-rated sales for TY 2007. CIR did not act upon the said administrative claims until almost ten (10) years later, denying the administrative claims for tax credit; thus, petitioner filed a Petition for Review before the Court in Division. The CTA Third Division granted CIR's Motion for Early Resolution and dismissed the taxpayer's Petition for Review for lack of jurisdiction on the basis that the judicial claim was filed out of time.

The Court en banc ruled that the taxpayer’s judicial claim was filed out of time. The Supreme Court, in a long line of cases, has consistently interpreted the 120+30-day period in refund or tax credit cases, pursuant to Section 112(C) of the Tax Code, as both mandatory and jurisdictional. The taxpayer may file the appeal within 30 days after the CIR denies the administrative claim within the 120-day waiting period, or it may file the appeal within 30 days from the expiration of the 120-day period if there is inaction on the part of the CIR. The CIR's inaction on an administrative claim for tax credit or refund during the 120-day period is "deemed a denial", pursuant to Section 7(a)(2) of RA 1125, as amended by Section 7 of RA 9282, and the taxpayer has 30 days from the expiration of the 120-day period to file its judicial claim with the CTA; otherwise, its failure to do so renders the "deemed a denial" decision of the CIR final and inappealable. (Lapanday Agricultural and Development Corporation v. CIR, CTA EB No. 2177, February 3, 2021)

When the CIR fails to take action on the administrative claim, the "inaction shall be deemed a denial" of the application for tax refund or credit; thus, the taxpayer must strictly comply with the mandatory period by filing an appeal with this Court within 30 days from such inaction.

In 2011, taxpayer filed with the BIR its administrative claims for the issuance of TCCs, for excess and unutilized input value-added tax (VAT) attributable to zero-rated sales for TY 2010. On 18 October 2018, the BIR denied all of taxpayer's administrative claims in a letter which the latter received on 13 November 2018. Within thirty (30) days from receipt thereof, taxpayer then filed its judicial claim for refund with the CTA. The CTA First Division granted CIR's Motion for Early Resolution and dismissed the taxpayer's Petition for Review for lack of jurisdiction on the basis that the judicial claim was filed out of time.

The Court en banc ruled that the taxpayer’s judicial claim was filed out of time. In a long line of cases, the Supreme Court, has ruled consistently that the 120+30-day period in refund or tax credit cases, pursuant to Section 112(C) of the Tax Code, as both mandatory and jurisdictional. Under such provision, taxpayers must await either for the decision of the CIR or for the lapse of the 120 days before filing their judicial claims with this Court. Pertinently, RA No. 1125, as amended, expressly provides that when the CIR fails to take action on the administrative claim, the "inaction shall be deemed a denial" of the application for tax refund or credit. The taxpayer-claimant must thus strictly comply with the mandatory period by filing an appeal with this Court within 30 days from such inaction, otherwise the court cannot validly acquire jurisdiction over it. (Lapanday Foods Corporation v. CIR, CTA EB No. 2200, February 3, 2021)

Allegations couched in the nature of a general assignment of error are not allowed under the Rules of Court and jurisprudence.

The Court in Division partially granted taxpayer's claim for refund/tax credit representing its unutilized input VAT attributable to its zero-rated sales of services. CIR asks the Court En Banc to take a second look at the official receipts submitted by taxpayer. The CIR merely alleged that the official receipts submitted by taxpayer do not contain the required information under the Tax Code and RR No. 16-05; thus, the Court should deny the taxpayer’s VAT refund/credit claim.

The Court En Banc held that it is not duty bound to rule on the CIR’s issue without the latter identifying the specific errors in the official documents.

Clearly, it is vital for a taxpayer claiming VAT refund/credit to prove that it had followed the invoicing requirements. Failure to comply with the same will cause the denial of the said claim. However, the CIR failed to cite the specific invoicing requirement respondent allegedly violated. In fact, the allegations in the instant Petition for Review are couched in the nature of a general assignment of error which are not allowed under the Rules of Court and jurisprudence. (CIR v. Kurimoto (Philippines) Corporation, CTA EB No. 2108, February 3, 2021)

Issues not duly raised before the proceedings in the Court below may not be ventilated for the first time in a motion for reconsideration or on appeal.

The Court in Division partially granted taxpayer's claim for refund/tax credit representing its unutilized input VAT attributable to its zero-rated sales of services. CIR argues that the documentary exhibits presented by taxpayer, specifically, the PEZA Certification, the Service Agreement, and official receipts, should be declared inadmissible since the witnesses who identified the same have no firsthand knowledge with regard to the authenticity and due execution of the said pieces of evidence.

The Court held that the CIR is now precluded to question the competence of taxpayer's witness to identify the said documents. Issues not duly raised before the proceedings in the Court below may not be ventilated for the first time in a motion for reconsideration or on appeal. CIR did not assail the competence of taxpayer's witness during trial. In fact, he did not even file his Comment to taxpayer's Formal Offer of Evidence. It was only in his Motion for Reconsideration where he raised the same. The Service Agreement referred to by CIR was not even offered by taxpayer during trial. Thus, the Court cannot be made to rule on an evidence that was not even formally offered by any of the parties. (CIR v. Kurimoto (Philippines) Corporation, CTA EB No. 2108, February 3, 2021)

The rule under RR 12-99 that non-response to a notice sent by registered within the prescribed period from date of the posting thereof in the mail is to be considered actually or constructively received by the taxpayer presumes that the notice was sent to the correct address.

The CIR argues that the LOAs, Checklist of Requirements, Revalidation Notice, NIC, PAN, FAN, Amended PAN, Amended FLD /FAN, Preliminary Collection Letter (PCL), and Final Notice Before Seizure (FNBS) were validly issued and served on taxpayer, although at its old address. Not only were they received by the same people who received the other notices; but also, taxpayer was able to protest and reply to the FLD, PCL, and the FNBS. Taxpayer asserts that in sending the assessment notices to its old address, despite proper registration with the BIR of its new address, the CIR failed to comply with the due process requirements.

The Court held that the CIR was well-informed of the change of address of the taxpayer. The evidence bears out that taxpayer updated its registration information to reflect its new address. If the taxpayer does his duty and duly informs the BIR of its change of address, then any communication sent to its old address becomes invalid and tolls the period within which the taxpayer is given to reply.

The applicable rules at the time the notices were sent allowed for constructive service wherein if the notice was sent by registered mail and no response was received from the taxpayer within the prescribed period from date of the posting thereof in the mail, the same was to be considered actually or constructively received by the taxpayer. However, this presumes that the notice was sent to the correct address. (CIR v. Vitalo Packaging International, Inc., CTA EB No. 2148, February 3, 2021)

The FAN /FLD must be received by the taxpayer or its authorized representative.

The CIR failed to present a certification of the postmaster that the assessment notice was duly issued and delivered to the taxpayer. Furthermore, the signatures in the registry return receipts remained unidentified and unauthenticated. Neither was the signatures thereon belonged to the taxpayer's authorized representatives. The FAN was received by the security guard of the new lessee of taxpayer's old premises and was not even taxpayer's employee.

The Court noted that Section 3.1.4 of RR 12-99 requires that the FAN /FLD must be received by the taxpayer or its authorized representative. Furthermore, under RMO 40-2019, a detailed record of all assessment notices issued by the CIR is required. Notably, among the details to be recorded by the Chief of the Assessment Division or the Head of the Reviewing Office are the name of taxpayer/person who received the assessment notice and, more importantly, the position/designation/relationship to the taxpayer, if not served to the taxpayer named in the assessment notice. (CIR v. Vitalo Packaging International, Inc., CTA EB No. 2148, February 3, 2021)

While the shipment date indicated in the Bills of Lading is considered as the date of sale of petitioner's exported products, the absence nonetheless of their corresponding sales invoices – dated within the period of claim – is fatal to taxpayer's claim for refund.

In the assailed Decision, the Court denied taxpayer's zero-rated sales on the ground that while they were supported by invoices, such were however dated outside the period of claim. In its MR, taxpayer argues that the Court erred in using the date of issuance of the sales invoices as basis in determining the zero-rated export sale since the bill of lading should be regarded as the actual date of export sales in view of the peculiar nature of export sale of mineral products.

The Court does not agree with the taxpayer. Section 106(A)(2)(a)(1) of the Tax Code, in relation to Section 113(A)(1), (B)(1), (2)(c), and (3) of the same Code and Section 4.113-1(A)(1), B(1), and (2)(c) of Revenue Regulations (RR) No. 16-05, requires a VAT registered person claiming VAT zero-rated export sales to present at least three (3) types of documents, to wit: a) the sales invoice as proof of sale of goods; b) bill of lading or airway bill as proof of actual shipment of goods from the Philippines to a foreign country; and, c) bank credit advice, certificate of bank remittance or any other document proving payment for the goods in acceptable foreign currency or its equivalent in goods and services. While the Court acknowledges that the shipment date indicated in the Bills of Lading is considered as the date of sale of petitioner's exported products, the absence nonetheless of their corresponding sales invoices – dated within the period of claim – is fatal to taxpayer's claim for refund. The Court cannot overemphasize the importance of proper substantiation of zero-rated sales being claimed by taxpayer as expressly provided for by law. (Oceanagold (Philippines), Inc. v. CIR, CTA Case Nos. 9207, 9277 & 9416, February 3, 2021)

An assessment against taxpayer based on unverified amounts extracted from BIR's own database must be cancelled for lack of factual basis.

CIR assessed the taxpayer on the undeclared sales. Allegedly, taxpayer failed to submit all the required documents to overturn the assessment that there was a discrepancy which resulted in unrecorded gross profit from CIR's verification from taxpayer's Summary of List of Purchases (SLP) vis-a-vis taxpayer's suppliers or income payments per SLS.

The Court held that the assessment against taxpayer based on under-declaration of sales must be cancelled for lack of factual basis as the same was based on unverified amounts extracted from BIR's own database. Records do not show that the amount from the purported third-party information (TPI) provided by the BIR was confirmed or verified. Without confirmation from third parties, the findings become doubtful as to the reliability and correctness of the assessment on the alleged undeclared sales. While tax assessments have the presumption of correctness and regularity in its favor. However, it is equally true that assessments should not be based on mere presumptions no matter how reasonable or logical the presumption might be. (Surplus Marketing Corporation v. CIR, CTA Case No. 9290, February 3, 2021)

Evidence submitted before the BIR in tax refund cases cannot be given probative value by the Court unless presented and formally offered anew by the taxpayer..

Taxpayer contented that the Court in Division erred in not granting its claim for refund of erroneously paid excise tax with respect to its product, considering that it submitted the requisite sworn statements of said product's net retail price before the BIR, hence, the same should have already been taken judicial notice of by the Court considering that it has appellate jurisdiction over the CIR's decisions in tax refund cases. Under the amendments introduced by RA 10351, the net retail price is the crucial factor in determining the excise tax actually due to an alcoholic beverage.

The Court held that it is incumbent upon the taxpayer to prove every minute aspect of his claim. He cannot simply rely on the evidence he has already presented in the administrative claim before the BIR for the success of the judicial claim for refund. He must present and offer anew with this Court the evidence already presented before the CIR and such other evidence (although was not submitted to the CIR during the administrative proceedings) which are necessary to prove his entitlement to his tax refund claim. Evidence submitted before the BIR in tax refund cases cannot be given probative value by the Court unless presented and formally offered anew by the taxpayer. (San Miguel Brewery, Inc. v. CIR, CTA EB Nos. 2144 and 2156, February 4, 2021)

Domestic purchases of goods and services that were destined for consumption within the ecozone are deemed exports of a taxpayer’s suppliers and should be free of VAT; hence, no input VAT should therefore be paid on such purchases.

The taxpayer, a PEZA-registered entity, filed a claim for refund allegedly representing its unutilized input value-added tax (VAT) attributable to its zero-rated sales. The CIR based his denial of the claim for refund on the provisions of RMC 74-99 stating that for invoices/receipts issued upon the effectivity of RMC No. 74-99, the claims for input VAT by PEZA-registered companies, regardless of the type or class of PEZA-registration, should be denied.

The Court cannot allow the taxpayer’s claim for refund. To begin with, no VAT should have been passed on to taxpayer by virtue of its status as a duly registered PEZA entity. Under the Destination Principle and the Cross Border Doctrine, actual export of goods and services from the Philippines to a foreign country must be free of VAT, and conversely, those destined for use or consumption within the Philippines shall be imposed with 12% VAT. For tax purposes, ecozones are effectively considered as a foreign territory separate and distinct from the customs territory, as provided under the Special Economic Zone Act of 1995. Thus, the domestic purchases of goods and services by the taxpayer that were destined for consumption within the ecozone are deemed exports of taxpayer's suppliers and should be free of VAT; hence, no input VAT should therefore be paid on such purchases. (Wells Fargo Enterprise Global Services, LLC-Philippines v. CIR, CTA Case No. 9849, February 8, 2021)

Taxpayer's failure to timely file the protest to the FAN does not make valid an otherwise void assessment.

The BIR Regional Director issued Tax Verification Number (TVN) authorizing the Revenue Officer to examine and audit the taxpayer for TY 2007. A certain Mel Cordero received the TVN. The taxpayer subsequently received the NIC, PAN and FAN. Taxpayer, however, belatedly filed a protest to the FAN.

The Court held that even considering the belated filing of taxpayer's protest to the FAN, it is an undisputed fact in the case at bar that BIR did not issue a LOA prior to pursuing an audit investigation of respondent. It is well-settled that the absence of an LOA is tantamount to a denial of a taxpayer's right to due process. Such absence is an incurable defect that renders the tax assessment void ab initio. Considering the circumstances of the case at bar, taxpayer's failure to timely file the protest to the FAN did not make valid the otherwise void assessment, especially since taxpayer's original Petition for Review before the Court in Division was timely filed. Taxpayer's arguments, though deserving scant consideration, cannot overshadow the nullity of CIR's action of pursuing an assessment of taxpayer through a mere TVN (CIR v. Penta Technology, Inc., CTA EB No. 2046, February 9, 2021).

The prevailing rule, in view of the issuance of RMC No. 54-2014, is that all complete documents are to be submitted upon the filing of the taxpayer's administrative claim for refund.

The taxpayer claims that the BIR's revenue officers requested additional documents during the course of the processing of its administrative claim for refund. The taxpayer complied with the BIR officials' written and verbal requests for additional documents as evidenced by the series of transmittal letters. In a letter dated November 11, 2014, petitioner indicated that "the Company has already submitted the complete documents in support of its application for refund of excess and unutilized input VAT for TY 2011”. Upon CIR’s denial of its application for refund, the taxpayer eventually filed its judicial claim on April 8, 2015.

The Court en banc finds that the factual milieu in the present case is analogous to the 2020 Zuellig case, involving the same parties and issue albeit referring to different taxable periods, where the Supreme Court ruled that verbal requests for additional documents are not prohibited provided they are duly made by authorized BIR officials. Thus, both verbal and written requests for additional documents made by authorized BIR officials may be used as basis in determining the date of submission of complete documents in support of an administrative claim for refund or tax credit of input VAT. In the present case, the 120-day period for the CIR to act on taxpayer's administrative claim should be reckoned from the November 11, 2014 Letter, the last letter of taxpayer indicating that it had already submitted the complete documents in support of its refund claim. Thus, counting 120 days from November 11, 2014, CIR had until March 11, 2015 to act on the administrative claim. In view of CIR's inaction on the subject claim, taxpayer then timely filed its judicial claim on April 8, 2015.

However, the prevailing rule now, in view of the issuance of RMC No. 54-2014, is that all complete documents are to be submitted upon the filing of the taxpayer's administrative claim for refund. (Zuellig Pharma Asia Pacific Ltd. Phils. ROHQ v. CIR, CTA EB No. 1915, February 10, 2021)

While Section 112(C) provides for two (2) points within which the 30-day period to file a judicial claim may start, the same are not alternative in nature.

Taxpayer's main contention is that Section 112(C) of the Tax Code provides for two (2) remedies available to a taxpayer seeking to appeal an unfavorable action on its administrative claim for input tax refund, namely, file a judicial claim within 30 days from: a) receipt of CIR's adverse decision or b) upon expiration of the 120-day period given to CIR to act upon said administrative claim for input tax refund. It is taxpayer's position that these remedies are alternative in nature. Thus, taxpayer argues that it cannot be deprived of its right to appeal an adverse decision issued beyond the 120-day period given to CIR to decide.

The Court ruled that the 30-day period given to a taxpayer to file a judicial claim for input tax refund shall start from which of the two starting points in Section 112(C) comes first. Taxpayers do not have the option to wait for an actual adverse decision by CIR before filing a judicial claim before this Court if the 120-day waiting period has already lapsed. Otherwise, such judicial action would be belatedly filed, thereby causing this Court to lose its jurisdiction to try the said judicial claim for input tax refund. The rationale for the mandatory and jurisdictional 120+30-day period is that inaction by respondent within the 120-day period given him to decide a claim for input tax refund is already treated a denial in itself. Hence, there is no more need for a taxpayer to wait for an actual denial as its request for input tax refund has been deemed denied, by express provision of law. (Lapanday Diversified Products Corp. v. CIR, CTA EB No. 2199, February 10, 2021)

A foreign corporation is taxable only for its income from sources within the Philippines.

CIR argues that taxpayer failed to obtain a tax treaty relief in order for its transaction to be exempt from withholding tax, in accordance with RMO No. 1-2000. The BIR, through an ITAD ruling, would have been the proper authority to conclude whether these transactions are subject or not to Philippine tax pursuant to the provisions of the applicable treaties. The taxpayer maintains that it is not obliged to withhold taxes arising from payments of service fees to its affiliates for services rendered outside the Philippines, on the basis of the Tax Code and not of a tax treaty.

The Court held that a foreign corporation is taxable only for its income from sources within the Philippines. Compensation for services performed in the Philippines is treated as an income from sources within the Philippines, while those performed outside of it are considered income from sources without the Philippines. In this case, taxpayer has sufficiently proven that the recipients of its payment of service fees are foreign corporations whose services were performed outside the Philippines. Taxpayer was able to demonstrate that the services performed by such foreign corporations were performed outside the Philippines, as shown by the Certifications on Offshore Services stating that no physical work was conducted in the Philippines, as all the services rendered were performed outside the Philippines and are not effectively connected to a permanent establishment in the Philippines. (CIR v. NCR Cebu Development Center, Inc., CTA EB No. 2150, February 10, 2021)

If the BIR decided to enforce the collection of unpaid tax through judicial action, particularly through the filing of a criminal charge before the DOJ, an assessment is not necessary.

The prosecution mainly argues in its Memorandum that the accused who is a dentist by profession and who owns Sacred Heart Dental Center is required to declare all his income for each taxable year as required under Section 74 (A) of the Tax Code. The taxpayer claims that the cases filed against him for willful failure to supply correct and accurate information provided under Section 255 of the NIRC of 1997 should be dismissed as the same were filed prior to the issuance of the PAN and FAN/FLD, which, accordingly, is a transgression of his right to due process.

The Court does not agree with the taxpayer. In enforcing the collection of unpaid taxes, Section 205, in relation to Section 222(a), both of the Tax Code,provides for two (2) remedies. One is through summary administrative remedies (i.e., distraint and/or levy) and the other is through judicial remedies (i.e., filing of criminal or civil action against the erring taxpayer). If the BIR opted to enforce collection through summary administrative remedies, it must first comply with the due process requirements laid down in Section 228 of the Tax Code in issuing assessment notices. Noncompliance therewith is tantamount to the denial of taxpayer's right to due process and, thus, effectively voiding the assessment/s issued against the latter. But if the BIR decided to enforce the collection of unpaid tax through judicial action, particularly through the filing of a criminal charge before the DOJ, an assessment is not necessary. (People v. Garcia, CTA Crim. Case Nos. O-572, O-573 & O-610, February 15, 2021)

The rule that tax exemptions should be construed strictly against the taxpayer presupposes that the taxpayer is clearly subject to the tax being levied against him. Where there is doubt, tax laws must be construed strictly against the government and in favor of the taxpayer.

The crux of the controversy lies on whether alkylate is encompassed as "other products of distillation" subject to excise tax under Section 148(e) of the Tax Code. In the assailed Decision, the CTA Second Division denied the taxpayer’s claim for refund for excise tax paid on the importation of alkylate, on the ground that alkylate, while not directly produced through the process of distillation, its raw materials, such as olefins and isobutane, are nevertheless products of distillation, without which alkylate cannot be formed.

The Court, on the MR filed by the taxpayer, finds the taxpayer's importation of alkylate as not subject to excise tax under Section 148(e) of the Tax Code. An article to be subject to excise tax, it must belong to any of the categories of goods enumerated in Title VI of the Tax Code. Therefore, goods are generally not subject to excise tax, unless otherwise provided. The rule that tax exemptions should be construed strictly against the taxpayer presupposes that the taxpayer is clearly subject to the tax being levied against him. Where there is doubt, tax laws must be construed strictly against the government and in favor of the taxpayer. Applying the strict interpretation doctrine to the instant case visa-vis the Court's finding that alkylate is not a product of distillation, but of alkylation, the logical conclusion is that alkylate is not subject to excise tax. Since the Congress did not clearly, expressly and unambiguously impose tax on alkylate (or those which are not directly produced by distillation) under Section 148(e) of the Tax Code, taxpayer's claim should have been resolved in its favor. (Petron Corporation v. CIR, CTA Case Nos. 9327 and 9460, February 15, 2021)

Note: (Dissenting Opinion of Casteñeda, Jr.,J.) Evidently, while alkylate is not directly produced through the process of distillation but by alkylation, still, it cannot be denied that its very existence was derived from the utilization of these two raw materials, namely. olefins and isobutane, which are both products of crude oil distillation. Thus, alkylate would not have come into existence without the presence of the said raw materials. Further, there is no double taxation in this case. The first imposition is simply concerned with the importation of articles, while the subsequent imposition is on the manufacturing or production of goods in the Philippines for domestic sale or consumption of for any other disposition. Such being the case, the imposition of excise tax is on two different subject matters. Therefore, no double taxation exists. In view of the foregoing, I vote to deny the present MR for lack of merit.

As regards Business taxes, what is being taxed is the purported privilege of doing business by the taxpayer within the territorial jurisdiction of the Local Government Unit.

NPC’s power generation business had ceased by operation of law upon the enactment of the EPIRA law on June 26, 2001. Despite this, Petitioner seeks to collect business taxes from NPC for the years 2004 to 2008.

Petitioner argues that the EPIRA Law is not automatic since the law also decrees that NPC shall execute the necessary documents to effect the transfer of ownership and possession of its assets, right, privileges, and liabilities to PSALM. Hence, according to Petitioner, it is correct in assessing NPC with business taxes for the latter’s operations within the territorial jurisdiction for the years 2004 to 2008.

The court, in ruling against the Petitioner, stated that Business taxes imposed in the exercise of police power for regulator purposes are paid for the privilege of carrying on a business in the year the tax was paid. Since what is being taxed is the purported privilege of doing business by the taxpayer within the territorial jurisdiction of Itogon, Benguet and not the latter’s supposed ownership and possession of power generation assets situated within such place, then Petitioner’s argument that the transfer of ownership of NPC’s existing assets and liabilities to PSALM through the execution of the necessary transfer documents is irrelevant. Hence, NPC has no more business activity within the territorial jurisdiction of Itogon, Benguet that may be subject to business taxes during the period in question. (Municipality of Itogon, Benguet v. National Power Corporation, CTA AC No. 238, February 16, 2020)

Note: Accordingly, the Court cannot validly treat the assessment notice sent to NPC as a notice to PSALM because to rule as such is to violate the PSALM’s due process rights. While it may be true that the IRR of the EPIRA Law apparently states that PSALM may operate its generation assets directly or through NPC, this Court is not inclined to engage in speculation and to hastily conclude in the present case that the notice sent to NPC amounted to notice to PSALM without any proof that PSALM is actually operating its generation assets through NPC.

Considering that the Court En Banc has appellate jurisdiction over decisions and resolutions of the Court in Division, it follows that it also has the power to issue all auxiliary writs in the exercise of said jurisdiction.

CIR argues that the Court in Division committed grave abuse of discretion amounting to lack or excess of jurisdiction in denying his Petition for Relief from Judgment. He contends that Court in Division should have relaxed the application of the technical rules of procedures given the special circumstances in this case. The taxpayer, on the other hand, contends that the filing of the Petition for Certiorari is improper. It explains that the CIR did not cite any basis to show that the Court in Division acted arbitrarily when it issued the assailed Resolutions. It points out that the Petition for Certiorari must fail since the CIR’s arguments are mere reiterations of his allegations in CTA Case No. 8830 which were already passed upon by the Court in Division.

The question pose in this case is whether the Court En Banc has jurisdiction to take cognizance of the present Petition for Certiorari. The Court En Banc in recent cases has ruled to take cognizance of Petitions for Certiorari questioning that propriety of the Court in Division’s decisions and resolutions, one of which is the case of CIR vs. The CTA Special 3rd Division, et. Al., where this Court, similar to this case, resolved a Petition for Certiorari questioning the Resolution issued by the Court in Division denying the Petition for Relief from Judgment filed by the CIR. Further, the Court En Banc finds the rationale in Kepco Case incompatible with the Revised Rules of the Court of Tax Appeals (RRCTA). In the Kepco Case, it was rationalized that this Court, as a collegial body, may not reverse, annul, or void a final decision rendered by its division. However, this is not the case in the CTA considering that Sec. 2 of the RRCTA specifically confers to the Court En Banc jurisdiction to review the decisions or resolutions promulgated by the Court in Division. Considering that the Court En Banc has appellate jurisdiction over decisions and resolutions of the Court in Division, then it follows that this Court also has the power to issue all auxiliary writs in the exercise of said jurisdiction consistent with the mandate of Sec. 6, Rule 135 of the Rules of Court. (Commissioner of Internal Revenue v. Court of Tax Appeals - Second Division, CTA EB No. 2062, February 16, 2021)

Note: (Dissenting Opinion of Bacorro-Villena, J.) The CTA En Banc has no jurisdiction over a petition for certiorari under Rule 65 of the Rules of Court involving its own division. This is undeniable given the Supreme Court’s declaration in CBK and taking into account the rulings in Land Bank and Kepco since, if the Court En Banc is not superior to any of its divisions and a petition for certiorari seeks the rectification of a lower court’s mistake, logic and reason dictate that the CTA En Banc has no jurisdiction to issue a writ of certiorari against the resolutions of its own divisions.

While Section 112 (C) of the Tax Code prior to TRAIN Law provides for two points within which the 30-day period to file a judicial claim may start, the same are not alternative in nature.

The Taxpayer in this case filed its administrative claims for input tax refund for the 2nd and 3rd quarters of taxable year 2006 on April 28, 2008. This was denied by the CIR in a letter received by the Taxpayer on September 14, 2018. The Taxpayer filed a Petition for Review before the Court in Division on October 15, 2018 to appeal said denial. The Court in division dismissed the case for lack of jurisdiction.

The Taxpayer argues that the pre-TRAIN Law version of Section 112 (C) of the Tax Code allowed the taxpayer the alternative remedies of filing the judicial claim (1) within the 30-day period from the receipt of decision of the respondent, or (2) within the 30-day period after the expiration of the 120-day waiting period.

The Court, in ruling against the Taxpayer, stated that prior to TRAIN Law, Section 112 (C) of the Tax Code provides for two points within which the 30-day period to file a judicial claim may start, namely: a) upon expiration of the 120-day period given to respondent to act on a request for input tax refund, and b) upon receipt of respondent’s adverse decision, the same are not alternative in nature. The 30-day period given to a taxpayer to file a judicial claim for input tax refund shall start from whichever of the two starting points comes first.

Considering that respondent did not act upon the administrative claims within the 120-day period or by August 28, 2008, petitioner should have filed its judicial claim with this Court following the 30-day period or on September 25, 2008. Hence, the Petition filed on November 19, 2019 was belatedly filed. (Lapanday Foods Corporation v. Commissioner of Internal Revenue, CTA EB No. 2176, February 16, 2021)

In claims for input VAT under Section 112 (C) of the NIRC, should the BIR find that the grant of refund is not proper, it must state in writing the legal and factual basis for the denial.

The Petitioner filed an administrative claim for refund of its unutilized input VAT attributable to its zero-rated sales for taxable year 2016. The Respondent granted a portion of the refund being claimed but denied the majority thereof without specifying the reason for the denial.

Petitioner argues that respondent violated its right to due process when he failed to put in writing the facts and the law on which the denial of its input VAT refund was based.

The Court, in finding that Respondent failed to state the legal and factual basis for the denial of Petitioner’s claim, stated that in claims for input VAT under Section 112 (C) of the National Internal Revenue Code of 1997, as amended, should the respondent find that the grant of refund is not proper, said respondent must state in writing the legal and factual basis for the denial. This is consistent with one of the fundamental requirements of due process. Since no statement of the legal and factual basis for the denial was made in, then there was a violation of Petitioner’s right to due process. (North Luzon Renewable Energy Corp. v. Commissioner of Internal Revenue, CTA Case No. 9886, February 19, 2021)

Note: Notwithstanding the foregoing failure to state the factual and legal basis for the denial of taxpayer’s claim for refund, however, taxpayer is not automatically entitled to its claim. Here, the taxpayer’s claim for refund was denied for failure to prove that its sales qualify for VAT zero-rating since there is no showing that it has been issued with a Certificate of Endorsement by the DOE.

Elementary is the rule that revenue officers conducting an examination of a taxpayer for purposes of determining the correct amount of taxes due must be armed with an LOA.

The Taxpayer was assessed for payment of surcharge, interest and compromise penalty for the late payment of its Withholding Tax on Compensation Return for the month of December 2013 without the issuance of an LOA. The CIR argues that the collection of surcharge and penalties accompanying the tax liabilities is justified and in accordance with law and the rules despite the absence of an LOA.

The Court, in ruling against the CIR, stated that elementary is the rule that revenue officers conducting an examination of a taxpayer for purposes of determining the correct amount of taxes due must be armed with an LOA. An LOA is a guarantee that tax agents will act only within the authority given them in auditing a taxpayer. It is an instrument of due process for the protection of taxpayers. Since there was no LOA authorizing the issuance of the assessment against respondent, the audit conducted is patently void. (Commissioner of internal Revenue v. Del Monte Philippines, Inc., CTA EB No. 2162, February 19, 2021)

Actions for tax refund or credit are in the nature of a claim for exemption and the law is not only construed in strictissimi juris against the taxpayer, but also the pieces of evidence presented entitling a taxpayer to an exemption must be strictly scrutinized and duly proven.

The taxpayer contends that it is entitled to a tax refund/credit under Section (B)(2) of the Tax Code. It argues that its transaction with Amadeus SA, allegedly a non-resident foreign corporation not doing business in the Philippines are considered zero-rated sale of services.

The CTA dismissed the claim for tax refund/credit. It ruled that the taxpayer failed to prove that it is engaged in zero-rated or effectively zero-rated sales of services. The following requirements are laid down by the Supreme Court to successfully prosecute a VAT refund claim under Section 108(B)(2) of the NIRC: (1) The services must be other than processing, manufacturing or repacking of goods; (2) The recipient of such services is doing business outside the Philippines; and (3) The payment for such services must be in acceptable foreign currency accounted for in accordance with the BSP rules and regulation.

In this case, the taxpayer did not satisfy the second requirement. A perusal of the submitted Amadeus Commercial Organization (“ACO”) Agreement clearly shows that such agreement paved the way for Amadeus SA, through the taxpayer, to further its purpose to continually promote, market and distribute the Amadeus System in the Philippines consistent with the definition of “doing business” in the Philippines under Section 3(d) of the Foreign Investment Act. The Court reiterated its consistent ruling that actions for tax refund or credit are in the nature of a claim for exemption and the law is not only construed in strictissimi juris against the taxpayer, but also the pieces of evidence presented entitling a taxpayer to an exemption must be strictly scrutinized and duly proven. (Amadeus Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 9664, February 22, 2021)

A motion for reconsideration of the denial of the administrative protest does not toll the 30-day period to appeal to the CTA.

The CTA En Banc affirmed the resolution of the CTA Third Division dismissing motu proprio the original petition filed by the taxpayer, for being filed out of time. The taxpayer received an undated FDDA issued by the CIR on July 26, 2016, denying the petitioner’s administrative protest. Pursuant to RR 12-19, as amended by RR 18-2013, the proper remedy was to file a Petition for Review before the CTA within 30 days from the receipt of the FDDA, or in this case, until August 19, 2016. However, the taxpayer opted to file an MR with the CIR on August 2, 2016. The Court ruled that the filing of the said MR does not toll the running of the 30-day period to appeal before the CTA.

In relying with the possibility that the CIR might reconsider the previous decision, the taxpayer waived its remedy of appeal before the CTA. The taxpayer erroneously thought it could still file an appeal within the period prescribed from receipt of the Demand Letter and failed to realize that it had long lost its remedy of appeal when it opted to file an MR with the CIR and awaited the latter’s resolution thereon. It must be noted that the Demand Letter, which was signed only by the ACIR, is not the decision appealable to the CTA but the FDDA that the CIR signed. (B. Nevalga Enterprises Corp. vs. Bureau of Internal Revenue, CTA EB No. 2171 (CTA Case No. 10159), February 19, 2021)

The Rules of Court apply suppletorily to the CTA’s own rules.

The CIR, in its petition, argues that the assessment against the taxpayer is valid. He alleged that the officer who issued the LOA is clothed with authority to issue the same. He likewise insists on the validity of the waivers that the taxpayer executed and that his right to assess the taxpayer for deficiency VAT has not yet prescribed since the latter filed a false return which is subject to 10-year prescription period from the discovery of the fraud pursuant to Section 222 of the NIRC, as amended.